By Ed Hewitt, Director of Natural Climate Solutions at Respira

Twelve months ago, I posed six questions for the carbon market to resolve so it could deliver more for nature. How did these matters progress in 2023? And what’s the outlook for 2024 and beyond? Below are the questions I asked and a status update for each.

Question 1: Will there be agreement about what ‘high quality’ looks like for nature-based carbon credits and will this build widespread trust?

Verdict: Progress on definitions, but a lot of work required to rebuild widespread trust following negative media coverage.

In 2023, my LinkedIn newsfeed seemed to be dominated by countless arguments and media articles about the ‘quality’ of nature-based carbon credits, ranging from scientific debates about baselines to concerning allegations around lack of robust governance, benefit sharing and human rights abuses.

Although negative publicity may seem like bad news for nature and carbon markets, it does demonstrate that the topic itself is important and interesting enough for the attention of mainstream media. In turn, this is useful for focussing minds around the importance of quality and defining it.

I’ve already seen first-hand how greater awareness of the issues uncovered in FTM and New Yorker on the Kariba project among developers can lead to the implantation of stronger, more transparent governance systems and revenue sharing mechanisms in their own projects.

Although certain (nameless) media outlets would like to claim the credit, there were also important long-standing milestones achieved and consensus around what quality looks like, which should enable all stakeholders to move on from these now tedious debates. With ICVCM having finalised its guidance around Core Carbon Principles, we now wait with baited breath to see which specific nature based ‘project types’ (methodologies) will receive CCP status in 2024. The new consolidated REDD+ methodology published by Verra should go a long way to resolving the baseline issues and perceived conflicts of interest. Furthermore, there was very useful practical guidance published by NCS Alliance on how to define and diligence high quality. Ratings agencies such as Sylvera, BeZero, Calyx and Renoster all continued to gain traction and raised large amounts of money to improve their offerings.

However, it remains to be seen if these new tools and consensus will be enough to rebuild the widespread trust in nature-based credit quality and integrity needed for the market to scale beyond its current size. The market needs to attract new buyers beyond the current – already convinced – established players. There are several industry initiatives underway which aim to communicate the underlying quality of many existing and new projects, all of which will need mainstream exposure to build consensus and attract new corporate entrants to consider buying.

Question 2: Will corporate claims guidance be agreed and gain widespread acceptance?

Verdict: Detailed guidance released. More tangible incentives needed.

Similar to the debate around ‘quality’, claims were also in the spotlight in 2023, mainly for the wrong reasons in the media. Lawsuits were even launched against large companies such as Delta for making allegedly misleading carbon neutral claims and the EU recently announced a ban on the term ‘carbon neutral’ from 2026. Again, this should set an incentive for all stakeholders to unite behind a trustworthy claims code. The VCMI’s new guidance is by far the most comprehensive attempt at this, and the finalisation of the guidance marked another important milestone – however, it still remains to be seen if it will be adopted at scale. It’s concerning how few companies would currently even qualify to make ‘silver’ claims and it’s certainly more complex than the previous ‘carbon neutral’ or ‘offsetting’ terminology.

Given the controversy around ‘carbon neutral’ and the impeding VCMI framework, it was interesting to see Apple – the world’s largest brand – still make a ‘carbon neutral’ claim for the release of the new Apple watch. Does this mean that the term is still alive and will drive demand, or will it be one final hurrah before a shift to the new VCMI framework or simply just disclosing transparently what one has done without making a catchy claim?

It was also encouraging to see VCMI, ICVCM and SBTi all come together to clarify the role each plays and to affirm they intend to work together. SBTi guidance on use of carbon credits is still the cause of confusion for many, while ‘Beyond Value Chain Mitigation’ (BVCM) still seems yet to be fully understood or incentivised. In 2024, I hope for increased clarity on this from SBTi and tangible alignment with VCMI and ICVCM.

Clarifying the terminology is of course important and there seems to have been a marked shift away from ‘offsetting’ – a positive development. However, having the right set of incentives to make the resulting claims is key to increased uptake and the area where attention must turn this year. Beyond simply being a worthwhile thing to do, what are the tangible financial incentives and/or regulatory requirements which will drive increased demand? Recent announcements by CFTC and IOSCO seem to point to carbon credits at least being considered for regulatory disclosure, although at this stage it remains to be seen whether that will drive increased demand or put people off.

Question 3: Will Article 6 be friend or foe for nature based carbon credits?

Verdict: Still no closer to a resolution – but does it really matter?

The lack of progress on Article 6 was reported by many to be a failure of COP28. Article 6.4 seems to be no closer and 6.2 still appears to lack appropriate standardisation, oversight and safeguards. There have been a few more pilot 6.2 trades such as the Bangkok E bus programme between Thailand and Switzerland, although so far none have focussed on nature-based credits, for reasons which are not entirely clear.

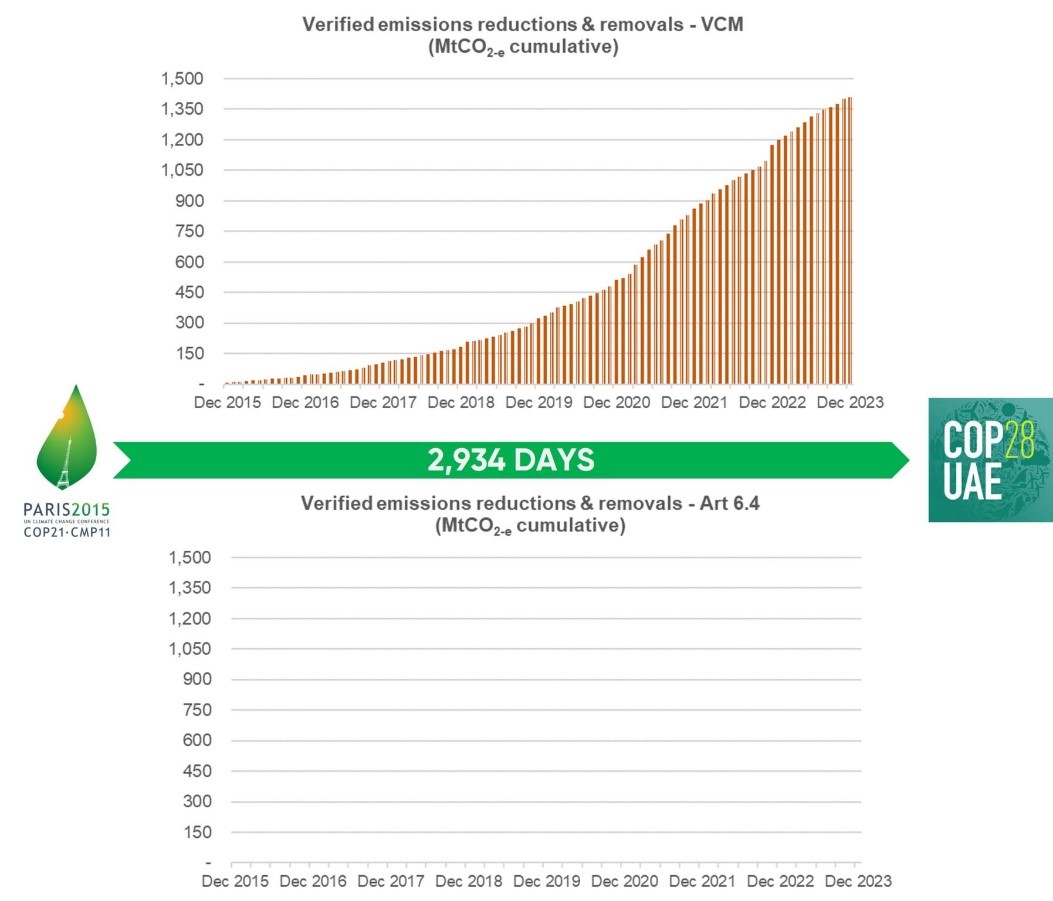

However, I’ve begun to question whether lack of progress on Article 6 even matters – particularly in the short term. This graph posted by my ex-colleague Rich Gilmore sums it up neatly. Cumulative tonnes retried under VCM since the Paris agreement on the top (over 1 billion tonnes). Cumulative tonnes retired under A6 since the Paris agreement below (zero).

Article 6 is for the future (and will no doubt form the basis of many negotiations at next year’s COP), while the VCM is the here and now and can be implemented today. We shouldn’t let the former distract from getting on with the latter.

Another important clarification, which appears to have gone pretty much unreported, is that the new VCMI guidance is silent on whether a Corresponding Adjustment is needed to make a valid voluntary claim. Essentially for the time being, this should be taken to mean that for voluntary purposes (as opposed to compliance or Article 6) it isn’t, which again should remove another reason for people to sit on the fence and do nothing.

Question 4: Will compliance programmes allow in more nature-based carbon credits?

Verdict: Some promising signs – but a long way to go.

Chile and Singapore recently joined California, South Africa and Colombia in allowing a certain percentage of nature-based carbon credits into their compliance programs. Brazil, which could be the world’s largest nature-based market, also signalled it would do the same thing just before Christmas. Conversations in the EU and UK still progress.

These are all positive signs – although to date compliance programs have not translated into large amounts of retirements for nature-based projects. The exception is Colombia, which according to MSCI data saw nearly 14 Mt (18% of the market) of NBS credit retirements in 2023 – the vast majority for compliance purposes to offset their tax scheme. Although prices were low, this does provide a tangible example of a compliance regime driving genuine demand. .

Question 5: Will biodiversity credits gain traction, and if they do what will the implications be for carbon credits from nature?

Verdict: Still in the early stages.

Interest in voluntary biodiversity credits continued to gain momentum in 2023 following the momentum from the adoption of the Global Biodiversity Framework in Montreal in late 2022. Plan Vivo released its Nature Standard at the end of the year, Verra made significant progress on its Nature Framework, BGCI released it’s Global Biodiversity Standard and many others all continue to develop workable methodologies.

The World Economic Forum pulled together two very useful summaries on demand drivers and the latest foundational work being done to build the market – including an estimate that the market could grow from its tiny c.$8m size today to $2bn by 2030 and $69bn by 2050. However, it is still too early to say what impact this will have on nature-based carbon credits as the foundations of the market are still being laid. In the meantime, carbon credits remain one of the few tangible tools to drive private finance at scale for nature-based projects available right now.

Question 6: Will macro economic growth return?

Verdict: A more promising macro environment is emerging.

Although global economic growth remained slow in 2023, many stock indices rebounded strongly and inflation rates began to drop. Global economic outlooks look brighter today than they did 12 months ago. Although continued economic growth is not seen as favourable by many respected environmentalists, the fact remains that so long as we live in a market-based capitalist economy, strong macro-economic conditions give companies more firepower to enter into the VCM.

Reflections and outlook

Far from being the ‘annus horrible’ some have depicted, I personally feel a renewed sense of optimism heading into 2024. The nature based (and broader) VCM proved to be remarkably resilient in 2023 despite the continued uncertainty and negative media attention. MSCI carbon markets data shows total retirements across the major registries for nature-based projects was nearly 75 Mt (41% of the total VCM), a 14% increase on 2022 and almost back to 2021 levels. Indeed, December 2023 saw the largest ever month of retirements in VCM history at 36 Mt (of which 16 Mt was for REDD+). Although reported nature based VCM trading prices fell slightly overall in 2023 (averaging well below $10/tonne), at Respira we had first hand experiences of prices holding up for existing high quality projects and lots of anecdotal evidence of prices increasing dramatically for a new wave of biodiversity rich and socially impactful nature based removal project credits currently in development.

Perhaps more importantly going forward, new Trove/MSCI research in 2023 revealed that more than $18bn of investment capital has been raised to invest in carbon credit funds in the last two and a half years alone, of which over 80% is earmarked for nature-based projects. This money has not yet been deployed and will result in a vast swathe of new projects. While both retirements and investment pledged are still small in comparison to what is required, these statistics should provide hope and reassurance that the market remains alive and well.

I would characterise 2023 as one where important foundations on quality and claims were laid. These are the two most important questions to resolve and form the foundations of a strong and growing VCM.

However, these technical guidelines and tools around quality and claims won’t be enough to grow the market by themselves. In 2024, I’d like to see more work on tangible incentives for corporations to buy and improve the perception and trust of the sector in general. It’s difficult to see a new market scaling rapidly when the public perception is negative. Increased positive mainstream media coverage would certainly go a long way to rebuilding that trust and perception of the industry. There were positive signs of this towards the end of 2023 with the often-critical Guardian, FT and Bloomberg all publishing more positive pieces. There were also positive noises on carbon markets from influential global leaders such as World Bank president Ajay Banga and US Climate Envoy John Kerry at COP, as well as various high profile African leaders, such as Kenya President William Ruto during Africa Climate Summit in September. All are positive signs that carbon markets are gaining widespread international acceptance from across the Global North and South.

Additional clarity and opportunities through Article 6 and compliance markets will come over the next few years, but there’s no reason in the meantime why the VCM can’t now move forward and grow with confidence.

What’s required is for us to get behind the strong foundations laid in the past year and build the high integrity carbon market 2.0 (some say 3.0 if you include CDM days) nature and the climate needs. If this much can be achieved in stormy economic and media conditions, imagine what could be possible in calmer waters.

Respira International is an carbon finance business. Acting as principal, Respira enters into long-term, large volume off-take contracts with carbon projects globally, in turn enabling buyers to progressively achieve emissions reductions targets.

Any opinions published in this commentary reflect the views of the author and not of Carbon Pulse.

Carbon Pulse allows subscriber companies to submit 1 piece of ‘contributed content’ (op-eds, advertorials, tenders/RFPs, etc) per year for free publication. This post appears in front of the paywall, so it’s readable by anyone. It also appears in our CP Daily newsletter once.

Beyond that, or for non-subscribers, we allow companies to purchase ‘sponsored posts’ at a rate of GBP 1,000 per post. These posts also appear in front of our paywall, while we feature them in our daily newsletter for 3 consecutive days (instead of 1).

You can read more about our contributed content/sponsored post offering here: https://carbon-pulse.com/advertising-brochure/