It’s been a rollercoaster ride for carbon markets over the past 12 months, with policy changes and ongoing scrutiny seeing some of the most historically stable voluntary carbon credits facing price pressure.

The latest analysis from Viridios’ AI-powered carbon credit pricing platform VAI shows that despite some negative market sentiment certain methodologies and geographies continue to trade at a premium.

“When we look across the 16,800 carbon projects on VAI, the data shows that location, methodology and co-benefits are among the key indicators of a carbon credit’s value,” says VAI’s Chief Market Intelligence Officer, Bertrand Le Nézet.

“The data also shows that transparency has a significant influence on carbon credit pricing across both voluntary and compliance carbon markets.”

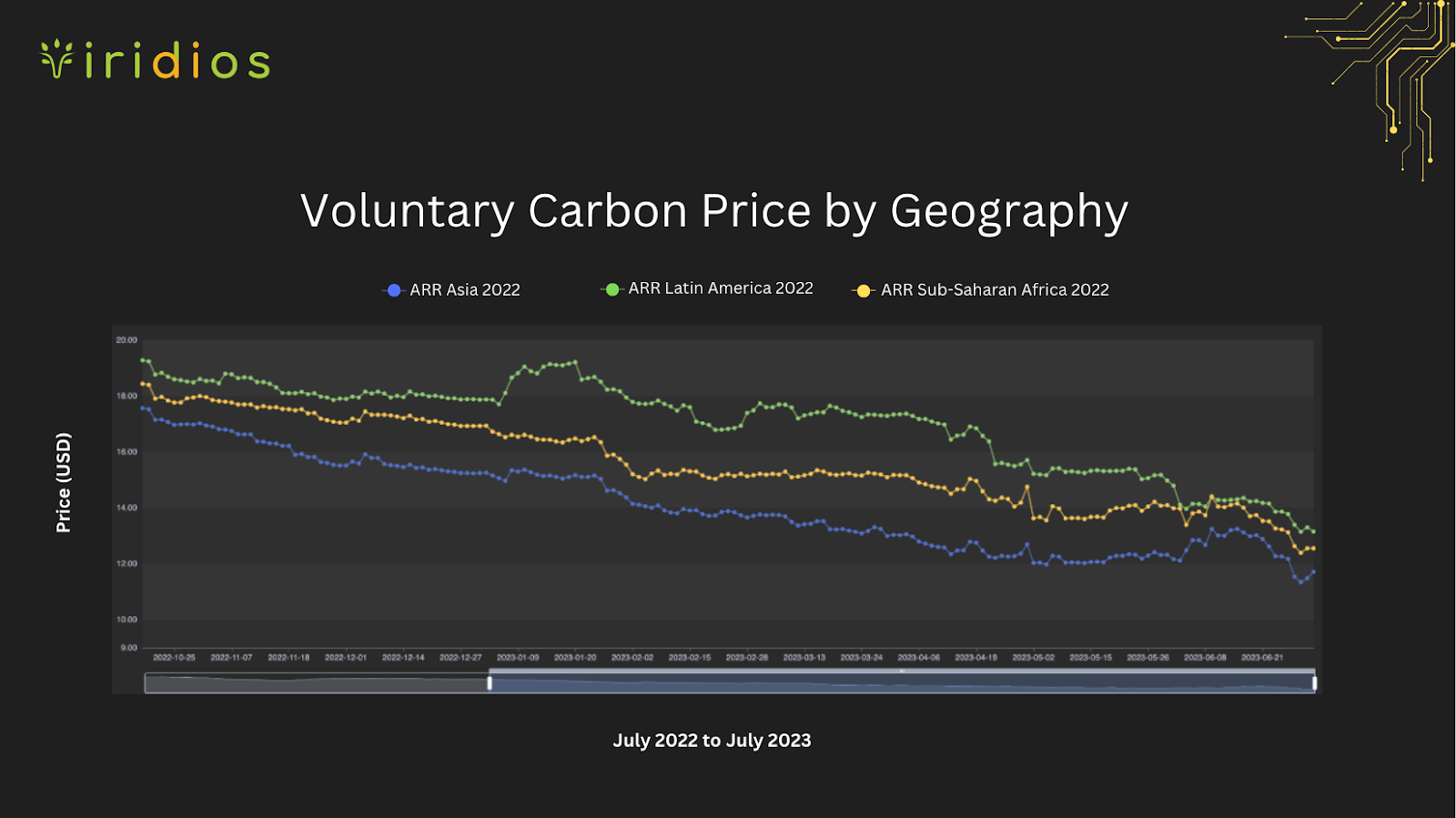

Geography

VAI data shows that the price of carbon credits can vary significantly by geography. For example, when you compare Afforestation, Reforestation and Revegetation (ARR) projects across Asia and Latin America over the past 6 months, on average, projects in Latin America traded at a premium in comparison to similar projects in Asia.

“Although developing economies can be difficult to navigate for investors, our data shows that the market participants often place a premium on carbon projects in some of these locations where they have a strategic aim,” Le Nézet says.

“With companies such as General Motors, IBM and 3M recently setting up operations in Latin America, it’s fast becoming a key location for some investors. Coupled with the fact that Argentina, Bolivia and Chile are being positioned as the ‘lithium triangle’ supporting the clean energy transition in the United States, it’s clear why there is demand for carbon credits that repair natural environments in these areas.”

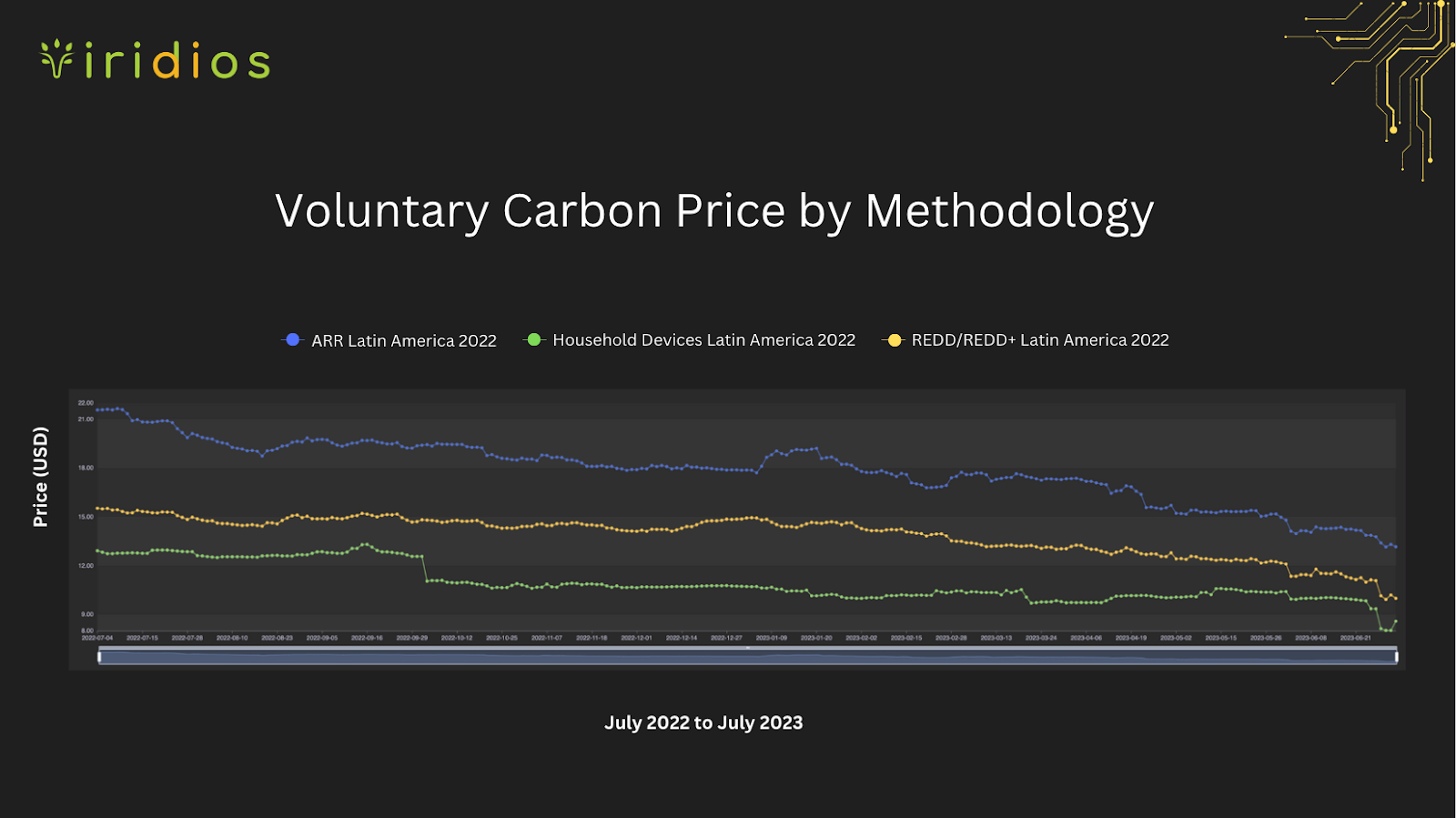

Methodology

As carbon markets continue to mature, the methodologies that underpin the creation of the carbon credits are evolving. VAI data shows that the market values certain types of methodologies above others. For example, over the past 12 months on average ARR credits have traded at a premium to REDD+ and Household Devices such as cookstoves.

“Our data shows that investors place a significantly higher value on removal credits with projects developed under the ARR methodology trading at a premium relative to Household Devices,” says Le Nézet.

Transparency

One of the major impediments to attracting investment in carbon markets has been timely, accurate and affordable access to carbon project information. As with most over-the-counter markets, by their nature, carbon markets can be opaque and difficult to navigate. However, through platforms such as VAI, market participants can access comprehensive data sets and insights on thousands of carbon projects around the world, allowing them to gain a better understanding of a project’s value all in one convenient place.

“Market transparency is critical to attracting investment in carbon projects, that’s why we have aggregated detailed information on more than 16,800 projects. From a project’s location, Standard, type, vintage of credit’s produced and eligibility to the Sustainable Development Goals (SDGs) it meets, providing investors with access to the information they need to research and compare carbon projects allows them to better understand the pricing,” Le Nézet says.

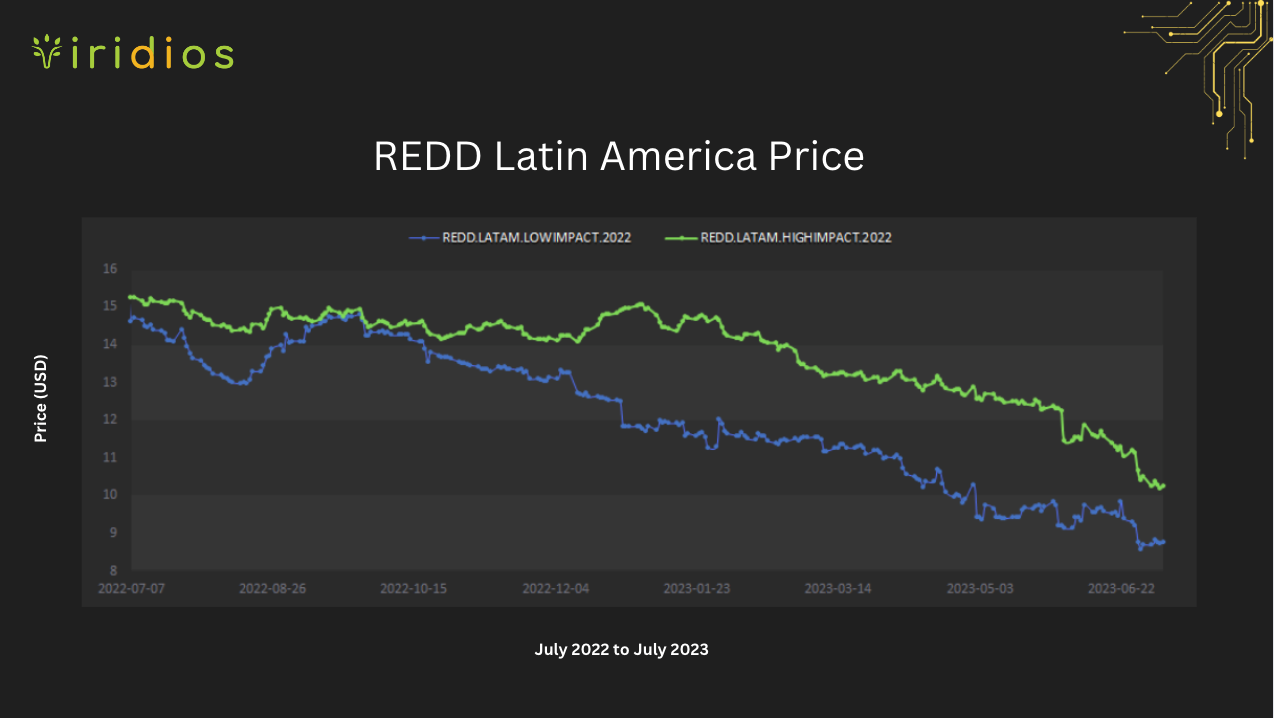

Co-benefits

As businesses look to implement their ESG commitments they are increasingly seeking detailed information on carbon projects’ co-benefits and SDGs. VAI’s in-house research shows that aligning carbon market investments and decarbonisation initiatives with specific SDGs has become a priority for some sectors.

To help businesses access SDG information on carbon projects, VAI has created models which accurately value carbon credits and interpret all inherent complexities, including detailed analysis on contributions to SDGs.

Perhaps one of the clearest examples of the value the market places on co-benefits is in the REDD carbon credits in Latin America. VAI’s data show that over the past 12 months REDD 2022 vintage high impact credits continue to trade at a significant premium (around 16%) compared to low impact credits developed around the same methodology.

“Carbon credits are a complex asset class, with the market placing a significant premium on projects which deliver some of the most sought after co-benefits. Given this, perhaps unsurprisingly, the data also shows that each individual SDGs associated with a carbon project has a discrete value,” says Le Nézet.

Carbon Credit Pricing and Climate Targets

Carbon credit pricing has evolved over many years, with markets getting more sophisticated in the way they value these unique assets. VAI’s data clearly shows how factors such as a carbon project’s location, the methodology it was developed under and the co-benefits it delivers, can impact its price.

Until recently, this information was not readily available to carbon market participants, making it difficult to compare carbon credits and make informed investment decisions. As carbon markets continue to mature, buyers will continue to seek greater clarity around how the carbon projects they invest in align with their ESG strategies. Being able to view and compare carbon credit prices and filter for key variables such as geography, methodology, SDGs and vintage, is an essential requirement which will ultimately help industry and government meet their climate targets.

Any opinions published in this commentary reflect the views of Viridios and not of Carbon Pulse.