A set of 50 metrics for investors to measure corporate progress on biodiversity action has been released by Nature Action 100 (NA100) in its benchmark.

The more than 200 investor participants in NA100 will be able to use the benchmark to assess the impact of their engagements with the initiative’s focus companies.

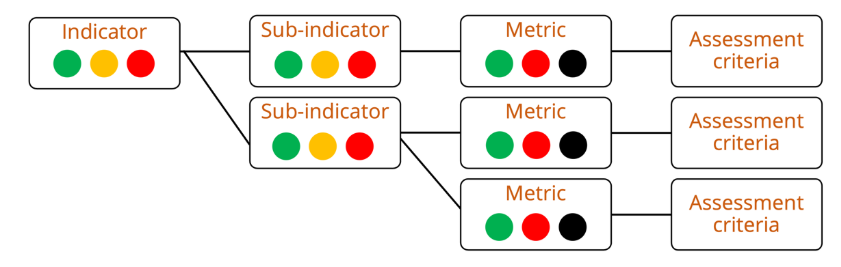

The metrics feed into 17 sub-indicators, which underpin the NA100’s six investor expectations, NA100 said in a press release.

For example, the metric of a commitment to avoiding contributing to nature loss drivers supports the expectation of ‘ambition’, NA100 said in an explanation document.

The engagement coalition will release the first annual company assessments based on the benchmark later this year.

The long-awaited benchmark reveals key areas of engagement for investors at the 100 focus companies, 16 months after the group’s launch at COP15 in Montreal.

GAINING MOMENTUM

NA100 intends to incorporate lessons learned from Climate Action 100+ (CA100), which is the world’s largest climate-focused investor initiative with more than 700 signatories.

However, the large US investor arms of several financial institutions left CA100 early this year – including JP Morgan Chase, State Street, and BlackRock – following the coalition asking signatories to take stronger action. CA100 has faced criticism for its lack of binding commitments, limited scope, and slow progress.

Meryl Richards, programme director of food and forests at non-profit Ceres, said NA100 was not expecting investors to leave the organisation. Ceres co-leads the NA100 secretariat with the Institutional Investors Group on Climate Change.

“At this point, we’re gaining investors. Because of the 700 or so investors that were part of CA100, it was a very small number that left,” Richards told Carbon Pulse.

While NA100 is not anticipating growing quite as large as CA100, the former’s engagements with companies are just getting started, she said.

“The number of investors who have signed up to NA100 is really a sign of the momentum on nature and biodiversity. There has been a lot of focus on particular drivers of nature loss like deforestation, for example.”

More than 200 institutional investors, representing over $28 trillion in assets under management or advice, have signed up to NA100.

HOW THE BENCHMARK WORKS

Companies will be assessed against criteria with a similar traffic light system to CA100 of:

- ‘Yes’ – green for having satisfied the criteria

- ‘No’ – red

- ‘Partial’ – orange

- ‘Not relevant’ – black

Credit: NA100

“The benchmark indicators announced today lay out clear high-level expectations for the ambitious actions that investors have called on companies to take to mitigate their nature-related financial risks,” said Leslie Cordes, vice president of programmes, at Ceres.

Examples of the metrics include that the focus company:

- Disclose targets to manage nature-related dependencies, impacts, risks, and/or opportunities

- Disclose the process for identifying relevant stakeholders across its value chain

- Disclose evidence that its board has sufficient expertise to oversee the company’s impacts on and engagement with Indigenous Peoples and local communities

- Ensure equitable access for Indigenous Peoples and local communities to land, resources, and territory where they hold rights or interests

- Disclose a strategy setting out the actions it intends to take to achieve its nature-related targets

The metric development process included consultation with investors, researchers, and representatives of Indigenous Peoples and local communities, NA100 said.

Last month, NA100 published a guide on engaging with companies across eight priority sectors for investors.

By Thomas Cox – t.cox@carbon-pulse.com

*** Click here to sign up to our twice-weekly biodiversity newsletter ***