A global challenge presents a global opportunity, according to venture capitalists (VC) from Silicon Valley to Singapore who see biodiversity companies as a new attractive area for investments, including one announced on Wednesday that will solely invest in biodiversity-related companies.

When countries signed the Kunming-Montreal Global Biodiversity Framework (GBF) they not only agreed to take immediate steps to reverse biodiversity loss, but they also agreed to set the ambitious time-bound target to mobilise $200 billion a year by 2030.

It’s hoped that this target will make a dent in the biodiversity financing gap, estimated at between $598-824 bln per year by the Paulson Institute.

However, the speed at which governments can mobilise financial resources is dependent on how fast bureaucracies can move. Governments are only now getting to grips with how to finance their national strategies and action plans. In the interim, venture capital has decided to see biodiversity loss as a global investment opportunity.

“Venture capital is a very good match to the speed and scale at which we need to bring solutions to bare,” Tom Quigley, managing director of new venture firm Superorganism, told Carbon Pulse.

Superorganism announced itself on Wednesday as “first venture capital firm dedicated to addressing the global biodiversity crisis”.

Quigley, a coral reef conservationist turned venture capitalist, and unicorn-backing angel investor Kevin Webb span startups, investment, and environmental expertise. The firm is expected to invest in up to 35 companies that address one of the five drivers of biodiversity loss outlined by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES): land-use change, climate change, pollution, natural resource use and exploitation, and invasive species.

“We need to be bringing solutions to scale yesterday, a venture scale company will be able to drive change in a short few years as they scale globally, which matches the kind of solutions we need to fight biodiversity loss,” Quigley said.

CONSERVATION AT THE CAP TABLE

For venture capitalists, problem and opportunity are two sides of the same coin, and usually the first two slides on any startup pitch deck. But it’s the opportunity that gets investors moving funds.

“Because so many industries are linked to biodiversity loss, there are endless opportunities for startups to help incumbents transition, or to compete directly against them,” said Kevin Webb, co-founder of Superorganism.

“The opportunity set is as large as climate tech, it maps against the problem in the same way,” Quigley added.

The climate tech opportunity has grown to a sizeable one in recent years. In Nov. 2022, PwC reported that more than $260 bln had been invested in more than 4,000 companies. Upwards of 240 companies were valued at more than $1 bln at the time, according to PwC’s research.

These are the kinds of numbers that excite VCs, but the Superorganism founders believe that biodiversity could be even bigger.

“The problem framing aligning to the IPBES five drivers of biodiversity loss helps to understand the problem of nature as distinct from the problems of climate,” said Quigley.

“There’s more direct risk from ecosystem collapse for some of the deep supply companies than necessarily there are for climate.”

“We’re starting to get a new understanding of our impacts and dependencies and there are opportunities in every industry, in particular the ones that are the largest drivers of biodiversity loss.”

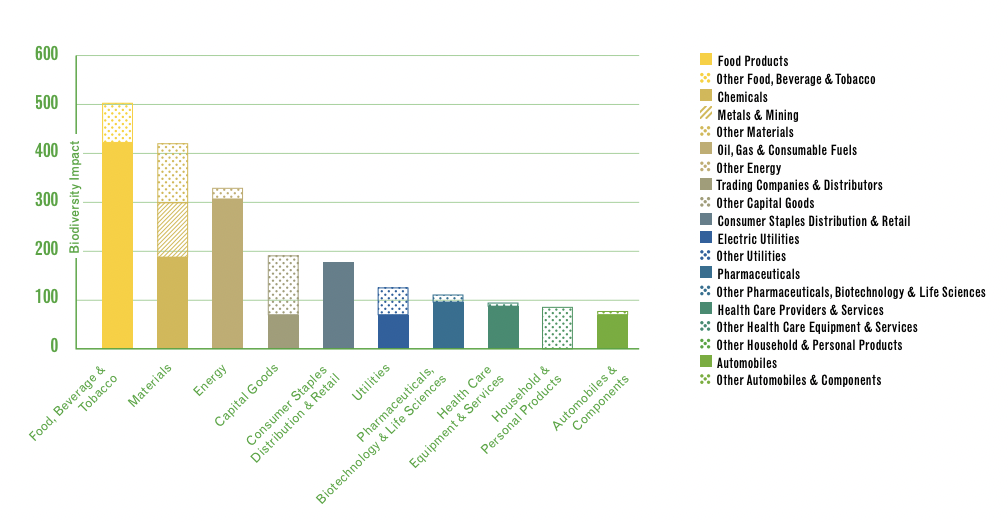

Finance for Biodiversity released research in April outlining the top 10 industries that are the largest drivers of biodiversity loss.

Biodiversity impact of the companies in Finance for Biodiversity’s top 250 list, split out by industries (2023).

It’s these existing markets and industries where Quigley sees the most opportunity to match venture-scale opportunities with those that have a global impact on biodiversity loss.

“For startups that have to hit product-market fit and scale near-term, we’re generally looking for nature-positive companies that can compete within existing multibillion-dollar markets.”

BIODIVERSE-VC

For an investment class that has rarely stepped into environmental impact outside of emissions, understanding where the problem-opportunity lies and what can be leveraged is front of mind for VCs, like Superorganism, developing investment thesis on the topic.

Several investors see incoming governance as a major leverage point for companies to offer new products, particularly tech-enabled solutions often termed “NatureTech”.

“The GBF is great, its an eye towards international commitment … but more interesting and important is the EU’s deforestation law, as well as the CSRD (Corporate Sustainability Reporting Directive) and TNFD (Taskforce on Nature-related Financial Disclosures),” Quigley said.

As nature loss exacerbates and the risk of localised ecosystem collapses becomes prevalent, businesses run the risk of losing access to their supply chain, which Quigley explained is adding impetus to a changing customer demand.

The new nature-venture firm was present in Nature Finance’s Nature Investor Circle webinar on Monday, with other VCs in part to explore how investors are thinking about investments in biodiversity-related companies.

One Nature Finance webinar participant told the audience that biodiversity credit markets could be four times larger than the carbon market. However, Webb from Superorganism doesn’t expect it to be a driving force just yet.

“We’re watching the emergence of biodiversity markets closely. While many of these mechanisms stand to benefit the investments we’re making, we don’t presently factor credits in as dependable revenue sources for our early-stage investments,” Webb told Carbon Pulse.

“As biodiversity credit markets mature, though, we believe the breadth of nature-positive activities that can be venture-scale will grow.”

“We know several groups doing trailblazing work on biodiversity credits, and we are contributing in a small way to pushing the space forward as founding partners of NatureFinance’s Nature Investor Circle.”

Regardless of the maturity of biodiversity markets, there is a vast range of potential companies that are able to solve niche challenges within the space, as one might expect from a thematic area that encompasses the variety of life on Earth.

NATURETECH RISING

The range of nature-related companies garnering investment from venture capital is varied, even in the early stages. Several of those are looking to “disrupt” existing global markets with new products.

“Many of the founders that we see are thinking about how do we use new technology to bring competitive products forward that make it a no-brainer for corporates to switch. Those are where we expect to see big opportunities,” Quigley told Carbon Pulse.

“Now you don’t have to pay a green premium, you’re able to buy a better product and it’s better for the world.”

Inversa, one of Superorganism’s early investments speaks to this approach. The company is creating luxury leather from invasive species, working with high-end brands to create an offtake market, and tackling the large cost challenges of invasive species control. The company established offtake agreements with luxury fashion brands for early traction and to change the market at scale.

A recent report from IPBES highlighted that invasive species cost the global economy nearly half a trillion dollars, with 8% of that related to money on invasive species control.

Superorganism’s investment thesis covers venture-scale tech and non-tech solutions to biodiversity loss, whereas other venture firms look to niche down further.

Other investment firms like Silverstand Capital, a family investment office based in Singapore that invests in natural capital companies, address a broader remit than just biodiversity alone. Through its “Biodiversity accelerator”, it provides funding for companies looking to solve challenges around biodiversity loss. The accelerator prioritised investment in monitoring, reporting, and verification (MRV) solutions and takes a more patient view of return on investment than many VCs.

“We have more flexibility in terms of our return expectations and also being able to deploy different types of capital, but all working towards the same sort of mission and looking at it at a more systems change level,” Patti Chu, impact investment manager with Silverstrand, told the Nature Finance webinar on Monday.

Similarly, 2150 is a London-based venture firm that solely looks for technology solutions for the urban environment and has been stepping into the biodiversity space. Last year the company led a $15 mln investment in global environmental DNA service provider NatureMetrics, which primarily works on biodiversity monitoring and assessment for infrastructure, construction, and extractive industries.

MRV startups, like those backed by Silverstand, may benefit from a certain level of maturity from the climate tech space, which often requires scientific expertise within the startup team. In this regard, scientific expertise may prove critical to the emerging Naturetech landscape.

Two of Superorganism’s early investments were university spinouts. Bluumbio, a company using enzymes to reduce chemical pollution, and Funga, a company that uses fungal microbiomes to boost forest resilience, have capitalised on the increasingly available capital for Naturetech.

Quigley expects to see an increasing number of academics come through into the startup space. He highlighted that the process is not “well-fledged”, but certain universities such as UC Berkeley, ETH Zurich and Cambridge are currently exploring innovation in nature markets.

“One of the more exciting things is the collaboration we’re seeing between founding teams, where you have one person where you have deep science expert with other founders that come from the tech world,” Quigley said, adding that academic expertise is likely to play an increasingly prominent role in VC investment within NatureTech in the coming years, not just through university spinouts but also through the investment decisions themselves.

ACADEMIC NECESSITY

With no single metric and a space that stretches from microorganisms to entire ecosystems, academic expertise will be critical for enabling VC firms to judge their investments in nature-related companies.

“There are many things that need more years of science and technology but there are some that use market mechanisms or new approaches or software enabled,” Quigley said.

“You can look at the science that underpins them and invest where the scientific risk is underwritten.”

Superorganism’s approach involves scientists in their due diligence process, using primary literature to understand the level of academic risk that they are comfortable with.

“[Founders] need to engage with the scientific community and have the defensibility of their impacts science approved, one challenge will be matching the speed of the science to tech including around metrics for measurement, which is an evolving conversation.”

He highlighted that founders may be responsive to company pivots and customer requirements, but that the company’s impact should stay true to them.

A high-risk capital approach is meeting early-stage market opportunities means that there will likely be tension between moving fast and slow. Fast to be responsive to the challenge, and slower to ground it all in evidence.

The view for venture capitalists like Quigley on the lookout for backable biodiversity companies is to start now:

“If we continue to do nothing, we’ll continue on the trajectory of 69% decline of wildlife populations in the last 50 years.”

By Tom Woolnough – tom@carbon-pulse.com

** Click here to sign up to our weekly biodiversity newsletter **