Just 20 food producers account for almost a fifth of the biodiversity impact from a group of the 250 biggest nature loss contributors in the world, a study has found.

Global investor coalition Finance for Biodiversity (FfB) Foundation, backed by 60 members and a total 126 signatories worldwide with €18.8 trillion in assets under management, carried out the study along with UK environmental consultants Globalbalance.

Combining four different biodiversity footprint tools, the study identified 250 of the 1,564 companies on the global MSCI index that it found account for as much as 73% of corporate biodiversity impact.

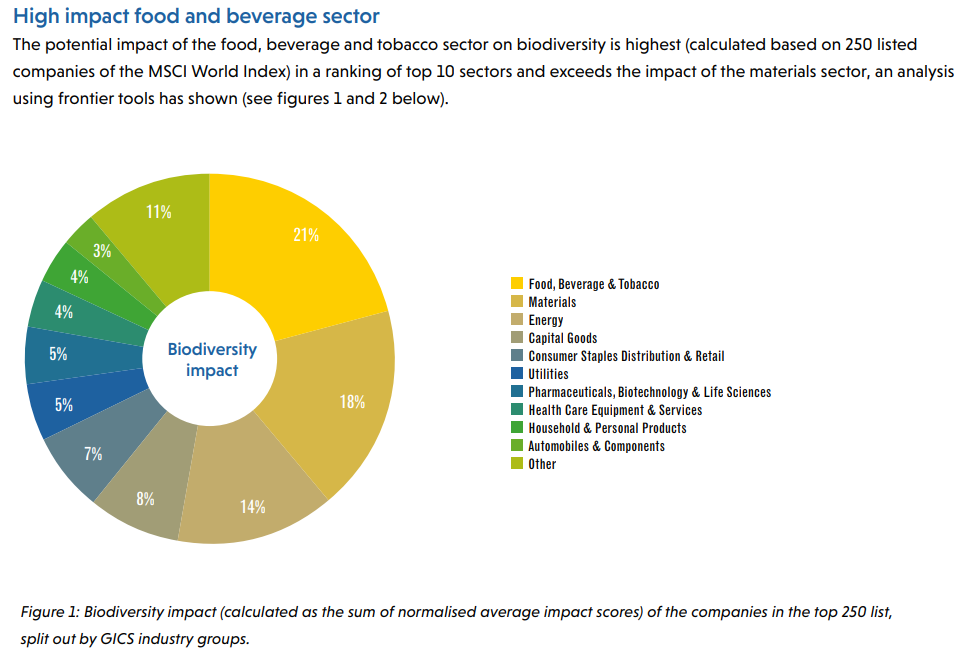

The researchers found that the food, beverage, and tobacco industry accounted for 21% of the impact, followed by materials (18%), energy (14%), and capital goods (8%).

FfB and its global members will use the results of the study for their company engagements going forward, the foundation said.

“Investors need this type of information for collaborative action on engagement with companies, impact assessment, and target setting on nature,” Anne-Marie Bor, the foundation’s co-founder, said in a statement.

“The analysis also lays the foundation for further collaboration with the four footprinting tool providers of the study. We are looking forward to doing an updated analysis with them to also look into dependencies and company performances on biodiversity,” she added.

BIG ONES

When sorting the 250 companies into sub-sectors, the data gave an even clearer picture of which industries bear the brunt of responsibility.

While “food, beverages, and tobacco” combined accounted for 21% of the impact, sub-sector data showed beverages and tobacco had only a marginal impact, whereas 20 food producers alone accounted for 18%.

They were followed by a group of 24 oil, gas, and consumable fuels companies that produced a total of 13% of the impact.

That means fewer than 50 corporations within food and fossil fuels together accounted for around one-third of the total impact.

Chemicals came a distant third with 8% and 20 companies, followed by consumer staples distribution & retail (7% – 17) and metals & mining (5% – 13).

“Investors may use the conclusions of the study to identify the key biodiversity risk areas and hot spots in terms of sectors and companies within their portfolios,” said Liudmila Strakodonskaya, a responsible investment analyst with AXA Investment Managers who also acts as a co-chair of FfB Foundation’s Impact Assessment working group.

“Engagement with those industries will then be key to ensure transformative change and transition to less nature-intensive business models,” she added.

Last week, Japanese chemicals and cosmetic giant Kao released a report illustrating the complexities of biodiversity reporting for multinationals.

However, the FfB report showed that despite those challenges, involvement from a relatively small number of companies can make significant contributions towards slowing and reversing the nature loss crisis.

“This means that a relatively small handful of corporate actors have tremendous power to help solve the biodiversity crisis, if they choose to,” Sophie Gilbert, senior lead, natural capital development with forest carbon marketplace NCX, said in a comment on LinkedIn.

“It also means that if we don’t communicate the importance of nature and biodiversity action to this small group, and motivate action via voluntary or regulatory means (or both), we are collectively out of luck.”

CAVEATS

The analysts did note some caveats with the study, such as the numbers representing potential impact rather than actual impact, due to a lack of available company data.

As well, given the MSCI index is dominated by North American and European companies while agriculture is somewhat underrepresented, a broader data set might have seen a slightly different final outcome.

Even so, the analysis helps build a strong accountability architecture to which corporations and financial institutions can be held accountable, according to Natasha Matic, a director at Global Commons Alliance’s Accountability Accelerator, which funded the study.

“It is also a wake-up call to investors to start preparing their portfolio companies beyond climate risks to also nature and biodiversity risks,” she said.

The four biodiversity tools used in the study were BIA-GBS (Carbon4Finance and CDC Biodiversite), CBF (Iceberg Data Lab and I Care), BFFI (ASN Bank, PRe Sustainability, and CREM), and GID (True Price, Wageningen Economic Research).

Results were verified using the ENCORE tool, developed by Global Canopy, UNEP Finance Initiative, and UNEP-WCMC.

By Stian Reklev – stian@carbon-pulse.com

*** Click here to sign up to our weekly biodiversity newsletter ***