By Matt Udberg, Carbon Markets Broker, ICAP

As the CME NGEO nature-based standardised carbon contract gained traction at the start of 2022, volume shifted from physical markets to futures, which opened the doors for banks and trading houses with otherwise difficult onboarding requirements in physical markets. As a result of the influx of these counterparties, volumes increased dramatically.

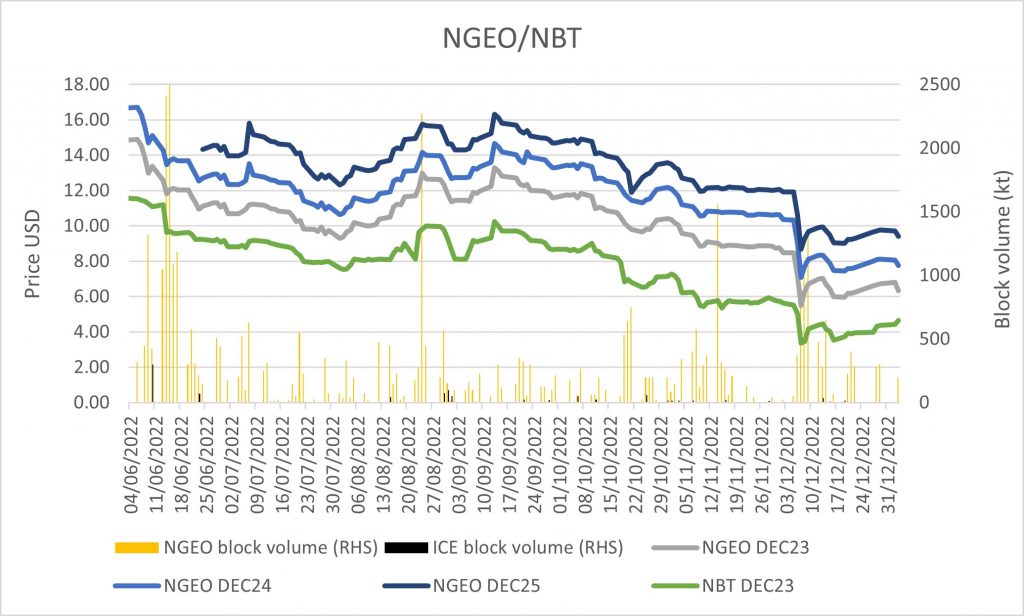

In May ICE announced the NBT, covering similar vintage splits to NGEO but across a range of expiries; Dec22 settlement caused complications surrounding the clearing mechanism, which ICE announced recently to be fixed for Dec23 expiry.

Prices fell in the wake of Russia’s invasion of Ukraine, as counterparties took risk-off strategies, with carbon – voluntary carbon especially – one of the first to go. As prices fell, stop-outs were breached, but with liquidity and bid-depth thin, price gapped down in turn tiggering further stop-outs and a faster falling market.

Traders instead looked to spreads (differing vintages and expiry specifications), taking positions whilst being protected against fundamental moves in the curve. The most common spread, the NGEO Dec22/23 started the year at $-2.50 with potentially some counterparties mistakenly thinking the spread represented a cost-of-carry trade, buying Dec22 to hold a year and redeliver into Dec23. In reality, NGEO expiries reflect different vintage specifications (Dec22: vintage 2016-20, Dec23: vintage 2018-2023) and therefore cannot be redelivered. The only way of trading the cost-of-carry in NGEO is buying physical spot, selling NGEO futures, marrying up the vintages and delivery specifications. E.g. buy REDD+ CCB v2020 spot, sell Dec25 NGEO. Alternatively, buy an ICE spread using the same product – buy NBT Dec22, sell NBT Dec24 for example.

The spread widened through H1 on account of Dec22 settlement concerns; vintage 2016-17 units could not be delivered into NGEO past the Dec22 expiry. ICE announced the NBT (v2016-20) in May, with expiries out to Dec25, and as such the spread narrowed once again.

Volume traded in spot vs futures spreads, with buyers making the most of their cheap cost of capital in the contango market. Buyers of the spread picked up VCS REDD+ CCB, to sell corresponding futures at a margin above the interest rate; sellers got cheap cash in comparison to conventional means at approximately 3.5%. This also set the standard for pricing spot physical projects against the futures for the first half of the year.

For example on a VCS REDD+ CCB v2019: by taking the corresponding future – Dec24 priced at $16.67 (on 1 June), discounting it at 3.5% over 31 months (number of months between spot date and contract’s expiry): $1.51, one could calculate the anticipated price of physical: $16.67 – $1.51 = $15.16.

However, delinkage of physical and futures pricing became apparent over H2 for three reasons.

Firstly, buyers recognised value in running due diligence on specific projects rather than taking the lucky-dip of NGEO delivery.

Secondly, as the futures market works on ‘cheapest-to-deliver’ specification, sellers with projects without negative publicity or controversy wanted a premium to the NGEO price.

Finally, the downward trend on the futures was recognised as being predominantly financials stopping-out; physical players were unconvinced of the move down, therefore holding offers higher rather than chasing down price, free from the same risk requirements enforcing financial to stop-out.

Physical projects now typically trade at a premium to the futures especially for buyers coming to market targeting specific projects, thus seeking a smaller pool of sellers.

Buyers and sellers are taking less notice of screen markets when pricing block trades, and even less for physical. For example, a 50c tick down in price onscreen may see a 25c drop in the block traded price, but only a 5c drop at the project level.

Liquidity improved over the summer as the market stabilised, and counterparties made use of the new exchange and sleeve-type counterparties to avoid onboarding new counterparties. Dec24 and 25 liquidity was thin until the end of 2022, as credit and risk departments gradually switched these expiries on for trading.

The macroeconomic climate worsened throughout Q4, and high interest rates tied up working capital. Many reported they felt end-user demand did not materialise, instead kicking the can down the road; retirement figures though disappointing for Q4, were strong in December.

COP27, while long awaited, did not seem to provide the direction and clarity the market anticipated, especially surrounding Article 6, after COP26 a year earlier had by comparison been a catalyst for a busy and bullish market.

Approaching expiry, the market expected fund-type rolling of Dec22 positions into Dec23, either avoiding Dec22 delivery or repositioning portfolios with more recent vintages; once it was clear all rolls had been completed, the spread narrowed.

The crash in prices exacerbated the tightening of the curve in December, and large volumes traded across both Dec22/23 and Dec23/24 spreads.

There was some excitement regarding options in Q4, with Dec23 expiry calls offered at 55% volatility. A functioning options market would present good opportunities for even physical-type players in the voluntary market, offering flexibility which forward trades cannot. For example a developer who sells a forward on volume they expect issuance of in the future, but then finds themselves stuck when issuance is delayed past contract date. They could instead buy a put (the right but not the obligation to sell a project on a given expiry date at a prespecified strike price), and if the project did not issue in time, they would not exercise the option.

Matt Udberg is a broker at ICAP Energy. ICAP is an interdealer broker providing physical and futures brokerage services across the voluntary carbon market, with desks in London, Singapore and New York. matthew.udberg@icap.com +44 2075 094 379

This communication provided by TP ICAP plc and/or one of its group companies (“TP ICAP”) and all information contained in or attached to it including, but not limited to indicative prices/levels and market commentary, (the “Information”) is for informational purposes only, is confidential and may be legally privileged. All intellectual property rights in the Information are, and shall remain, the property of TP ICAP. The Information is subject to TP ICAP’s terms of business as published or communicated to clients from time to time and is directed to Eligible Counterparties and Professional Customers only and is not intended for Retail Clients (as each term is defined by the rules of the Financial Conduct Authority (“FCA”)).

The Information is not, and should not be construed as, a live price, an offer, bid, recommendation or solicitation in relation to any financial instrument or investment or to participate in any particular trading strategy. The Information shall not be used for any purpose that would cause it to become a benchmark under the rules of any jurisdiction. The Information is not to be relied upon and is not warranted, either expressly or by implication, as to completeness, timeliness, accuracy, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed. Access to the Information by anyone other than the intended recipient is unauthorised and any disclosure, copying or redistribution is prohibited without TP ICAP’s prior written approval.

In no circumstances will TP ICAP be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information.

The terms of this disclaimer are governed by the laws of England and Wales. For further regulatory information and our terms of business, please see www.tpicap.com.

Any opinions published in this commentary reflect the views of the author(s) and not of Carbon Pulse.