By Stefan Feuchtinger, Head of Market Research and Analysis at Vertis Environmental Finance (VEF)

What is ETS2? Who is covered, when does it start?

The ETS2 is expected to start in 2027 (unless the delay to 2028 clause is triggered). ETS2 covers three main sectors: road transport, buildings and the so called “other sectors”. Those fall under the share of the EU industry that is currently not covered by ETS1, (e.g. installations below the 20MW threshold).

ETS2 is a separate market from ETS1, which will be about the same size. Eventually, at some point after 2030, the two ETS will likely merge into one. ETS2 differs from ETS1 in various aspects: Firstly, there will not be any free allocation. Secondly, the compliance obligation falls under the fuel provider/person who sells the fuel to the entity that burns it, while ETS1 is applicable on the actual burning of the fuel. Finally, process emissions are not covered under this scheme.

Why do you believe a linking between ETS1 and ETS2 is likely after 2030?

First of all, the EU has used Directive 2003/87, the ETS1 Directive, to enshrine all rules for ETS 2. Secondly, the general design is quite similar, e.g. regarding the MSR. Thirdly, and most importantly, as supply drops significantly, the closer we get to both systems’ carbon neutrality, the more likely liquidity will drop significantly. It therefore makes sense to merge both systems into one to retain a functioning market.

How likely is it that the system gets delayed to 2028?

This situation is not very likely – unless geopolitics get out of hand. There are two clauses in the Directive that would lead to a delay by maximum 1 year, if one or both conditions are met:

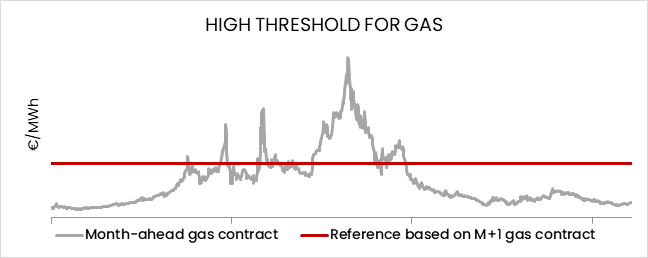

- The average TTF gas price for the six calendar months ending 30 June 2026 was higher than the average TTF gas price in February and March 2022. This would mean an average level of TTF of around €104/MWh for around 6 months.

Source: VEF

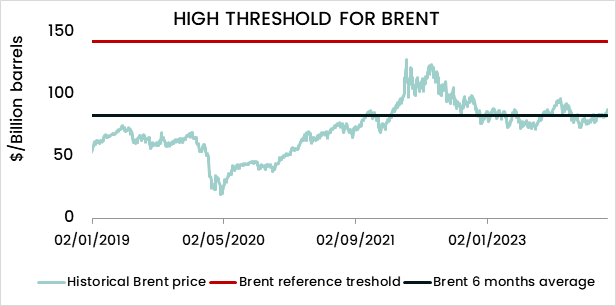

- The average Brent crude oil price for the six calendar months ending 30 June 2026 was more than twice the average Brent crude oil price during the five preceding years. To get an idea, this would currently mean a level of around $142/barrel.

Source: VEF

Will there be double compliance for an industry that is already complying with ETS1? If not, will it be better to be in ETS1 or ETS2?

There will not be double compliance. This will be ensured by reports that the industrials concerned will have to submit, indicating which portion of the fuel they bought goes into ETS1 installations vs ETS2 installations, allowing them to get exempted for the ETS2 fuel carbon cost for ETS1 installations.

What about systems with installed thermal power up to 20 MW, will they be covered?

Yes, that is exactly the type of industrial installations that will be exposed to ETS2. The difference, however, is, that the surrendering obligation will not be on the owner of these installations but the fuel supplier. The owner of the installation will however have to report fuel usage that goes into ETS1 vs ETS2 installations, so that the ETS2 price can be charged for the corresponding fuels that get burnt in those installations.

Germany already has a national system similar to ETS 2. Will there be double compliance or will Germany be exempted?

There is a clause that exempts countries that already have an equivalent system in place if they request it. However, the German authorities have informed us that they do not plan to make use of that clause and would rather prefer to move over to the ETS2. We can expect the German system to end in 2026 (compliance obligation in 2027) in case the ETS2 does, as expected, commence in 2027.

Can you expand on the small industrial installations that will be covered under ETS2: what types of installations are we talking about? What is your initial impression regarding the level of preparedness of operators to comply with the new system?

These can be any type of industries including all current ETS1 sectors like cement, steel, chemicals, fertilisers, glass, pulp & paper etc. It is probably too early to speak about preparedness as the topic is still new to the majority of stakeholders, but their readiness is currently very low.

What would you expect to happen to ETS 2 in case of a serious recession?

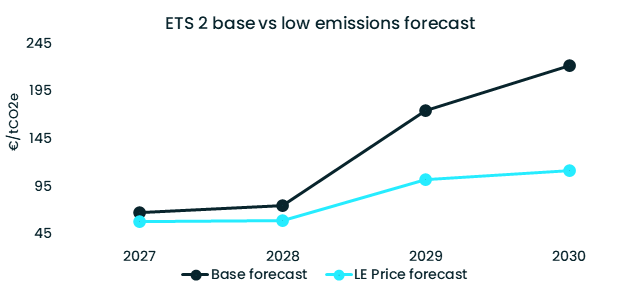

While ETS1 free allocation gets adjusted for every 15% production drop within an installation, ETS2 does not have free allocation and hence lacks such an adjustment. On the one hand, it could therefore be said that ETS1 could deal slightly better with a recession than ETS2. On the other hand, the mere fact that supply is extremely tight in ETS2 likely means that even in such a case, it would be more of a temporary relief than a structural one. Either way both ETS1 and 2 have an MSR in place that can provide some relief in both directions. While it would depend a lot on how deep the demand reduction goes, a full-blown recession would likely be somewhere in the range of our low emissions scenario. This scenario foresees about a 29% reduction in ETS2 emissions by 2030 compared to 2023, which would lead to a price of around €112 by 2030.

Source: VEF

What industry sectors will be transferred from ETS 1 to ETS2 and how will it affect ETS 1 carbon price?

None of the industries will be transferred from one to the other. Instead, ETS2 will apply to all fuel emissions that are not already covered under ETS1. This effectively means that all fuel emissions will be covered, including if an installation falls out of the ETS1 because it does not reach the minimum thresholds (ie. 20MW minimum threshold). A company with both ETS1 and ETS2 relevant fuel consumption will have to report the amount of fuel it uses for ETS1 covered installations. That way, it will be possible to distinguish between the two and not create double counting. For ETS1 emissions, the compliance obligation will remain on its shoulders. For ETS2 fuel consumption, it will contribute indirectly by paying a (higher) fuel price.

Is there a list of companies that will be part of the ETS2?

Not yet, the relevant companies must get registered this year so that the authorities should be in the possession of a list by the end of the 2024. Whether this list will be shared/available through a registry any time soon is not currently known to us.

How do derive the results for the prices in different scenarios? What is the modelling behind it ? Is there an optimization equation taking demand-supply in the picture?

Yes, the model considers basic supply and demand, potential abatement as a result of higher prices (even though we consider abatement from road transport especially to be rather limited due to low elasticity of demand) and uses a mix of historic ETS1 and expected ETS2 sensitivity curves to derive the final price point.

Would we see a scenario similar to the UK ETS where EUAs were used at first as a proxy hedge?

Judging from today, this seems to be a likely scenario indeed – however it also depends on whether exchanges will start offering futures on EUA2 allowances ahead of time and whether some actors would be willing to sell these ahead of the spot market being set up. In absence of that, we expect additional demand for ETS1 to only start slowly in 2025 before picking up somewhat during 2026.

How do you think the European elections will influence the EUETS2?

Since the ETS2 legislation has already entered into force, the elections will hardly change anything in the short and medium terms. On the margins, they could have an effect on its implementation, for instance when the Climate Change Committee meets to decide on additional MSR releases. If elections results reflect current polls, leading to a right-wing shift, the focus could perhaps slightly change from strict targets towards industrial feasibility. Nevertheless, the true impact of this year’s election would not be felt before the system gets reformed the first time to make it “fit for post-2030”.

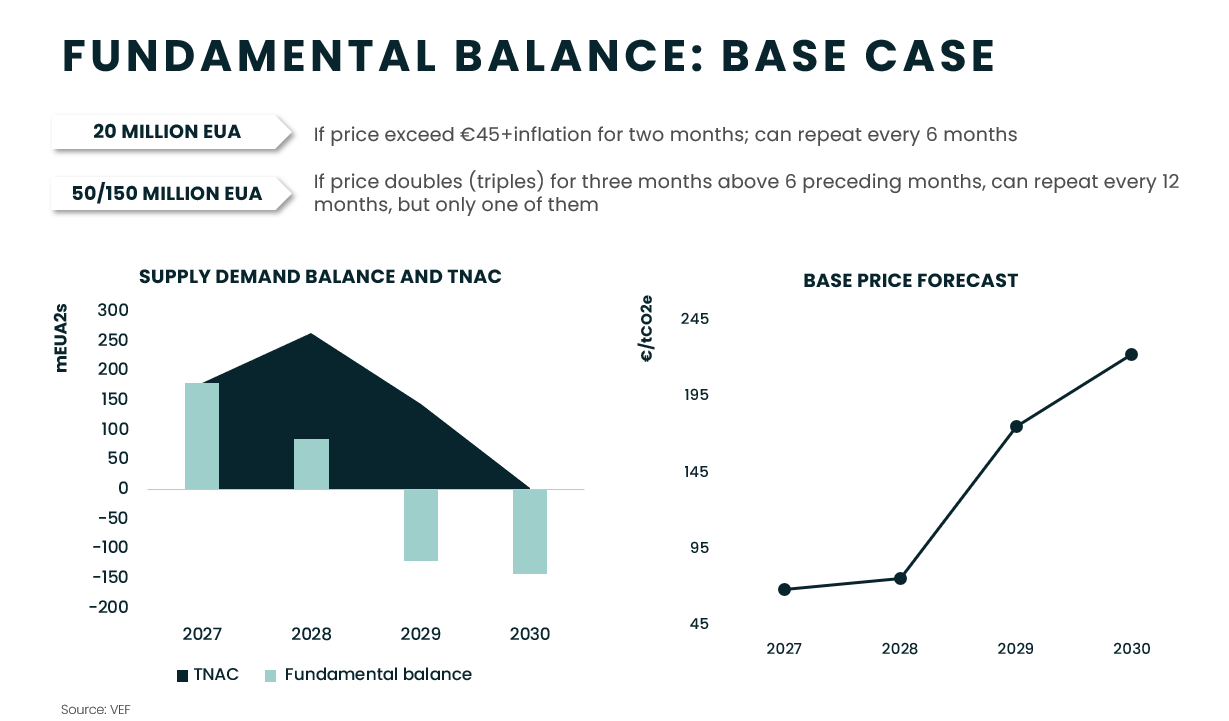

Your scenarios show prices of EUA2 quickly going above the €45 threshold set by policymakers as the maximum. Why is this the case? And what happens once the threshold is reached, do you expect policy-makers to intervene?

Contrary to common understanding, the €45 level is not a maximum. It is merely a level that triggers a release of some 20m allowances from the MSR. What is important in this regard is that first, the actual price trigger will be higher because the law states that it is €45 + inflation, so that we could easily expect a price trigger in the €50-60 range. Second, a release of 20m in a market that is similar in size as the ETS1 is just a drop on the hot stone, especially if it turns out to be as tight as our modelling assumes. As a result, we believe that other than for a short while initially, this level will be broken through once demand starts ramping up.

Source: VEF

Any opinions published in this commentary reflect the views of the author and not of Carbon Pulse.

Carbon Pulse allows subscriber companies to submit 1 piece of ‘contributed content’ (op-eds, advertorials, tenders/RFPs, etc) per year for free publication. This post appears in front of the paywall, so it’s readable by anyone. It also appears in our CP Daily newsletter once.

Beyond that, or for non-subscribers, we allow companies to purchase ‘sponsored posts’ at a rate of GBP 1,000 per post. These posts also appear in front of our paywall, while we feature them in our daily newsletter for 3 consecutive days (instead of 1).

You can read more about our contributed content/sponsored post offering here: https://carbon-pulse.com/advertising-brochure/