(Promoted content – Sponsored by CME Group)

By Russell Blinch, for CME Group

- After the UN climate meeting in Egypt, carbon market participants look to establish a pricing benchmark similar to those present in other key commodities

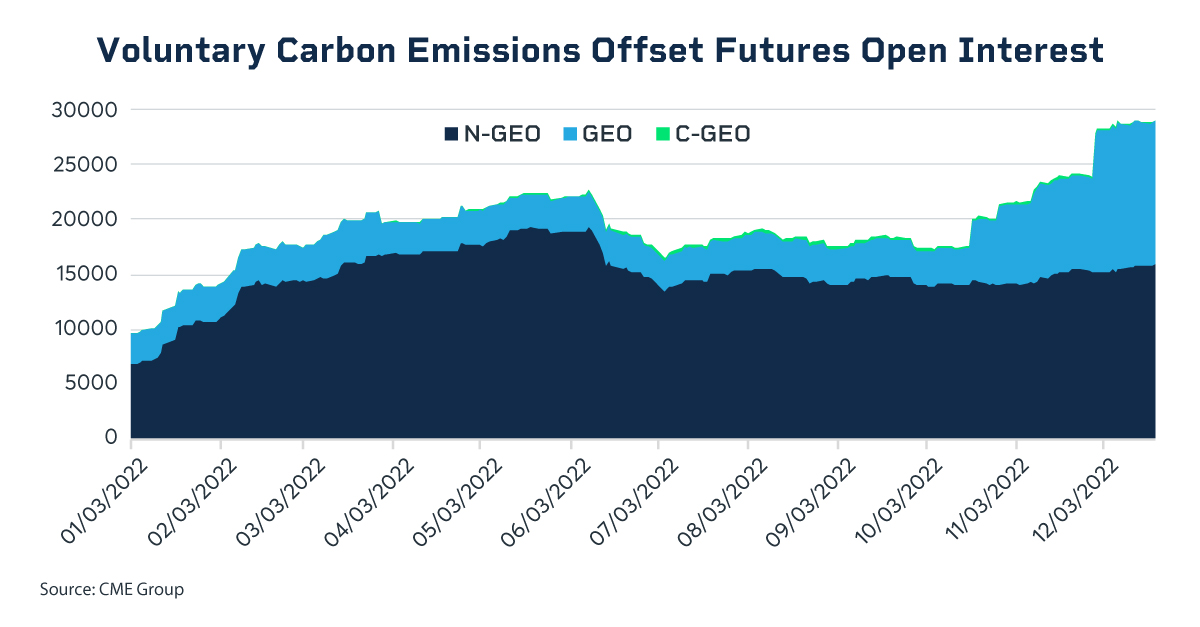

- Carbon offset futures from CME Group reached record interest in December

The race to carbon neutrality faced headwinds in 2022, including uncertain progress at the UN climate talks. However, corporations are keen to press ahead with a variety of tools to get the job done, such as embracing the voluntary carbon offset market.

A positive backdrop for business in the coming year will be the persistent evolution of benchmark prices in those carbon markets, providing investors transparency and reference prices, similar to the way benchmarks have evolved in everything from gold to grains.

Companies may well rely on these emerging reference prices as they are under pressure from consumers and governments to meet their climate commitments. They will have to shrug off the lack of breakthroughs at the COP27 meeting that wrapped up after marathon talks in November.

“With the conclusion of COP27 in Sharm El-Sheik, Egypt, we are reminded that while the annual UN climate gathering is a predictable event – the path to net zero is anything but,” McKinsey & Company, a consulting company, said in a blog post.

Business leaders at the meeting signalled they will move ahead on their climate commitments, despite the current challenges in the global economy. “While there is ongoing debate about whether enough is achieved at COP, private sector leaders showed up with a mindset of ‘let’s get it done,’ even if precise measurements and outcomes are not yet exactly clear,” according to the McKinsey post.

Delegates faced a broad agenda at the COP 27 climate meeting, including holding talks on Article 6 of the Paris Climate Accords that deal with how carbon markets will be governed globally. Those talks will continue into 2023, including focusing on how countries and corporations can buy carbon credits to help meet their climate pledges, according to a report from Reuters.

But there was some ground for optimism. “After years of negotiations about whether carbon markets under the Paris Agreement would actually exist, now they are at the stage of actually setting them up,” said Jonathan Crook, policy analyst at the non-profit Carbon Market Watch, as quoted by the Reuters report. By the end of the COP meetings, delegates were working with a 60-page document on how international carbon trade might work.

“The texts provide key elements to implement high-integrity carbon markets that can help deliver net zero ambitions for all countries,” Dirk Forrister, president of the International Emissions Trading Association, said in a statement.

The Importance of a Carbon Benchmark

Industry analysts argue investors will need carbon offset markets, spot and futures, more than ever to gain a window on what it costs to offset a metric ton of carbon. Carbon futures help provide those all-important benchmarks, similar to the way futures set prices on everything from corn to copper.

Read More About Global Emissions Offset Futures

A carbon offset credit is a transferable instrument certified by independent entities or governments, and each credit represents a reduction of one metric ton of carbon dioxide, or an equivalent greenhouse gas. To be effective, the credits must represent an environmentally sound project that helps to mitigate climate change — such as preserving a forest that was slated to be cleared. After purchasing a credit, a company retires it to claim a reduction in their own greenhouse gas reduction goals.

But the challenge in offsetting is how to price the credits, and that’s where futures markets come in. CME Group launched the GEO futures contract in 2021 with the aim of making it a global benchmark, giving customers a way to manage risk, and helping in price discovery.

Jessica Masters, director of energy products at CME Group, said the GEO works as intended. “When companies get involved in an offsetting project, they will check the markets to see what the prices are. Ultimately, there needs to be a benchmark, otherwise everyone’s just throwing darts blindly.”

She noted how benchmarks provide the transparency so critical for investors on whether to participate in markets at all, as they must know whether the decisions they are making are sound or not. “It provides people with the ability to make strategic business decisions,” Masters said. “It provides them with legitimate risk management tools because again with that transparency, they get the price discovery, and a forward curve with market price signals.”

David Kane, Partner, Commodities & Trading at Baringa Partners, a London-based consultancy, sees benchmarks as something that is both vital and evolving for carbon markets. “I think that the benchmarking is still emerging. If we think of the more established commodity markets and the volumes and liquidity within those markets, then price discovery is there and people use those benchmarks to value their particular books and to come up with credible hedging strategies.”

“These benchmarks underpin how these businesses manage risk. And without those benchmarks the volatility in the pricing of those particular commodities which lead to huge amounts of risk and large swings in profit and loss. That’s the other side of the coin —- if there’s not a benchmark, it is very difficult to manage around that, but it will emerge for carbon markets.”

Sarah Leugers, Chief Strategy Officer for Gold Standard, a registry that certifies carbon offsetting projects, says there is technical complexity to the market that some companies find difficult to navigate. “Futures contracts really help there a lot, or other types of offtake agreements,” she said. “It’s primarily the stability of the price signal.”

Business Won’t be Deterred

Meanwhile, interest in carbon offsets continues to build. The value of the voluntary carbon market surged to over $2 billion this year, according to a report from the Ecosystem Marketplace.

Open interest – the number of open, unsettled futures contracts – for the CME Group suite of GEO contracts rose to nearly 30,000 in mid-December, a record.

Headwinds in High-Rate World

Wisconsin-based U.S. Venture is an example of how a company can use carbon futures. The company focuses on sustainable energy solutions, and it takes a multi-pronged approach to meeting carbon reduction goals. The company taps the carbon futures market to hedge forecasted emissions for clients, as well as using offsets for its own needs. “As project developers for farmers, forest owners, and waste sites, we use futures to manage risk and monetize credits for clients,” Alex Haas, environmental credits manager for U.S. Venture, said in an interview.

But he said the current high-interest rate environment poses its own challenges. “The high and rising interest rates will continue to be a headwind for several months,” he said. “During this bear market, we need standard setters to set clear and reasonable standards that give end users confidence in using voluntary carbon credits as part of their sustainability plans.”

With interest in futures contracts growing, and a pricing benchmark for carbon offsets gaining steam, participants in the offsets market appear to be gaining confidence in the long-term importance of the voluntary carbon market.

The news and opinions published in this advertorial reflect the views of the author(s), not of Carbon Pulse.