In the run-up to the Ontario Cap and Trade Forum on April 26-27 at the Allstream Centre in Toronto, Canadian Clean Energy Conferences is producing a series of article and interviews featuring the key topics concerning regulated entities under Ontario’s program. This first article focuses on the key challenges and opportunities presented by the province’s new carbon regulations.

By Adrienne Baker, Director, Canadian Clean Energy Conferences

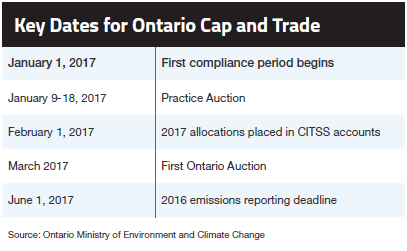

With the program launch two weeks ago, and the first auction coming up in March, Ontario’s cap and trade program is a critical focus for the 110 organizations that are mandatory participants. These include fuel suppliers, natural gas facilities and distributors as well as a number of steel, mining, pulp and paper, auto, food processing, and cement companies that meet the threshold of 25,000 or more tonnes of greenhouse gas emissions per year.

Rosalind Cooper

“This is a new system and so there is naturally a great deal of uncertainty and fear,” says Rosalind Cooper, a partner with Toronto-based law firm Fasken-Martineau. For many organizations, this is the first time participating in a live carbon market which brings new liabilities and opportunities. “Compliance entities that are prepared will have a clear advantage as we have seen with the California and European markets,” comments Michael Berends, Head of Carbon Sales at ClearBlue Markets, who has extensive experience advising companies on carbon trading strategies.

Being prepared can be a major challenge, however, as it requires a complete understanding of the inherent risks and potential benefits of participating in a carbon market. While large industrial emitters have been given a number of free allowances for the next three years, experts agree it’s critical to define a strategy early on. “All the facilities that emit over 25,000 tonnes a year were successful in negotiating free allocation of allowances but typically not enough to cover all their emissions through 2020, so they will likely have a modest liability that will grow as the amount freely allocated is reduced,” notes Duncan Rotherham, Vice President of ICF, a leading advisor on energy and environmental management.

Initially the carbon price in Ontario is expected to be around $18 a tonne and emissions will be capped at roughly 142 million metric tonnes per year. Emissions levels will gradually be reduced by 4.2% a year until they reach 124.6 million metric tonnes in 2020. “We know what the reductions are going to be for the next 3 years and companies have to plan for that,” comments Fasken-Martineau’s Cooper. “And if companies can’t achieve these reductions, they need to gure out how many credits they need to purchase. My concern is that a lot of organizations may not be as far along as they would like to be in planning for this.”

What is your carbon liability?

Defining and tracking an organization’s carbon liability is a critical step in developing a successful cap and trade strategy. Cécile Michoux, who led Rio Tinto Fer et Titane’s carbon strategy in Quebec up until a year ago, and is now a climate specialist at Cascades, suggests diligently tracking free allowances versus compliance requirements. “When I was at Rio Tinto, we were simulating our greenhouse gas emissions based on our production plans to estimate the compliance requirements under the regulation while taking into account our free allowances,” she recalls. “We kept these numbers updated frequently to track how things were evolving.”

Michael Berends

Identifying and monitoring a company’s carbon liability not only minimizes risks it also opens up opportunities. Companies that have a clear picture of their ability to buy, sell or hold allowances may be able to take advantage of potential price differences in the auction and secondary markets early on, explains ClearBlue Markets’ Berends. “This all depends, of course, on whether a compliance entity has the ability internally to execute on a transaction,” he adds.

Indeed, executing on trades involves close cooperation across many departments including credit, finance, procurement, accounting, environmental, and communications teams with senior management giving final sign-off. This is a major change from the historical model of environmental managers heading greenhouse gas initiatives. “We see a lot of cases where entities aren’t ready internally in the WCI and European markets and are not monetizing their free allowances or realizing their full quota of offsets that are trading at a discount to allowances,” observes Berends. “This is basically like leaving money on the table.”

Ontario’s first auction

Following the practice auction on January 17, Ontario’s first auction is expected in March. Gas distributors and refineries are expected to participate since they will need to purchase allowances but the rest of the mandatory and voluntary participants will have a choice.

Cascades’ Michoux says that participating early can help an organization gain knowledge and experience in all the prerequisites and internal coordination required to execute a trade. “It doesn’t have to involve a lot of money but it is good to practice to see how the platform works and how you can bid,” she says. “It is not recommended to wait until the end of the compliance period to buy permits at the auction.”

Early participation can also have financial advantages if, for instance, free allowances are oversupplied. Companies could then trade extra permits and be able to invest that capital in projects that further reduce their carbon exposure, explains Cascades’ Michoux.

ClearBlue Markets’ Berends takes this idea a step further suggesting organizations with free allowances could essentially borrow from those allowances to fund emissions reductions today. “There are ways to sell your allowances to a bank and then agree to buy them back in the future at a certain price which frees you up to use that capital to fund your internal carbon emissions reduction projects,” he explains. “This is basically borrowing from your free allowances and not leaving yourself exposed to price changes in the future.”

ClearBlue Markets’ Berends takes this idea a step further suggesting organizations with free allowances could essentially borrow from those allowances to fund emissions reductions today. “There are ways to sell your allowances to a bank and then agree to buy them back in the future at a certain price which frees you up to use that capital to fund your internal carbon emissions reduction projects,” he explains. “This is basically borrowing from your free allowances and not leaving yourself exposed to price changes in the future.”

The first auction in March is very important to watch as it will set the price for the secondary market until Ontario is linked with the larger WCI in 2018, notes Berends. The secondary market essentially allows entities to buy and sell carbon allowances to each other. This market is not expected to be very liquid in the early stages but will play a critical role in helping Ontario industries meet compliance obligations as the carbon cap declines. Once the province links to the broader WCI, pricing and liquidity in the secondary market will improve dramatically as companies gain access to the much larger California market.

Cécile Michoux

Reducing carbon exposure

Ontario, Quebec and California have set ambitious carbon reduction goals for 2030 and all jurisdictions are currently working on their post-2020 market rules to meet these emissions targets. Experts agree that organizations will need a comprehensive carbon trading strategy as well as further emissions reductions to meet future compliance obligations.

“There are very few low-hanging fruit in terms of carbon savings for industry in general,” notes Cascades’ Michoux. “2030 is not so far away and the amount of reductions we are looking at is close to a revolution. Sectors will need to all work together and to think out of the box.”

Ontario participants are naturally concerned about the post-2020 market design. “If the province gets aggressive post-2020, the worry is whether Terrace Bay Mill will have the financial resources to react to its demands,” comments Traci Bryar, Environmental Superintendent, Terrace Bay Mill. “We are concerned how the steep mandatory decline in emissions will compare to business realities on the ground.”

ICF’s Rotherham says regulatory uncertainty is the biggest challenge for large industrials who don’t know what their free allocations will be and what emissions reductions they will have to meet post-2020. “There is also uncertainty around the price of carbon,” he adds. “So there is carbon market risk and carbon policy risk which makes it hard to know how to invest now as an important input to a long term strategy.”

Duncan Rotherham

Ontario’s Ministry of Environment and Climate Change is currently consulting with key stakeholders to inform post-2020 cap and trade program design and recognizes the importance of providing policy certainty and reducing business risk. The government also plans to reinvest the $1.9 billion expected annually from the cap and trade program into projects that reduce carbon emissions. Under Ontario’s Climate Change Action Plan, the government has proposed the creation of a Green Bank which is expected to help businesses finance low-carbon technologies and energy efficiency measures.

“An advantage in Ontario is that there are significant revenues being generated through the sale of the allowances and it looks like large industrials will get more than their fair share to invest in their facilities to increase their carbon competitiveness, however it will be important to allocate funds to the small industrials who were not afforded the benefit of free allowance and are as trade exposed as the large operators,” comments ICF’s Rotherham.

Offset Protocols and Consultations

Another key development for Ontario participants is the creation of carbon offset protocols. The Ontario Government has engaged Climate Action Reserve to adapt 13 existing offset protocols (from existing regulated and voluntary offset markets) for use in Ontario and Quebec under the cap and trade program. Three protocols will be in place early this year, with the remainder in place by 2017-18.

Carbon offsets will play a key role for Ontario participants that have reduced their emissions to the point where further reductions are either cost-prohibitive or would negatively impact performance. Mandatory participants will able to meet up to 8% of their compliance obligation for each compliance period using offset credits which finance qualified projects that generate GHG emissions reductions.

Ontario’s Ministry of Environment and Climate Change is currently seeking input on a draft regulatory proposal on offset credits. The highlights of the proposal include:

- allowing people, companies and organizations to claim offset credits for projects that reduce or remove greenhouse gases and meet the requirements detailed in offset protocols

- offering one offset credit to projects that reduce or remove one tonne of carbon dioxide

- allowing companies covered by the cap and trade program to use offset credits to meet a portion of their compliance obligations

- developing a public web-based offsets registry to track projects applying for and receiving Ontario offset credits

For more information, please visit: https://www.ontario.ca/page/cap-and-trade-offset-credits-and-protocols#section-0

Ontario Industries Exploring Further Carbon Reductions

By Anna Golubova

Most mandatory participants in Ontario have been actively monitoring and driving down carbon emissions for over a decade, resulting in significant emissions savings. With the introduction of cap and trade, industry is now looking to identify new solutions to further reduce carbon exposure.

“If everything stayed the same, there wouldn’t be enough of a financial incentive to invest, as the carbon price is not very expensive right now,” notes Gordon Adams, Environmental Coordinator at ARAUCO North America. “But, since it will be going up, the uncertainty of the post-2020 scenario is encouraging industry to invest into alternative energy solutions.”

One of the changes being considered by ARAUCO for its Sault Ste Marie’s facility is switching to electrical heating. “It will require significant investment, but potential savings could cut our bill in half,” adds Adams, who is heading compliance for cap and trade.

GreenField Specialty Alcohols, another participant in Ontario’s cap and trade, is also exploring new solutions for driving further carbon savings. “The carbon price is bound to go up year after year,” observes John Creighton, Managing Director of Logistics, GreenField Specialty Alcohols. “So, we are starting to embrace a long-term outlook, which includes green projects. Renewables, however, require significant investment, so we are looking for financial support.”

Brampton Brick is interested in replacing natural gas with biomass but the significant investment is currently a deterrent. “Other things we are working on include improving efficiency, stopping leakage and insulating better,” reports Brad Cobbledick, Vice President Technical Services, Brampton Brick.

Terrace Bay Mill, another industrial cap and trade participant, currently uses a significant amount of biomass. “To change our technology beyond 85% biomass would cost us $30-$40 million,” says Traci Bryar, Environmental Superintendent at Terrace Bay Mill, which is one of Ontario’s biggest paper grade pulp mills. The company is currently exploring using better grades of oil and fuel efficiency optimization to further reduce its carbon emissions.

Greater Toronto Airports Authority, which operates Toronto Pearson International Airport, is interested in the carbon reduction benefits of solar and geothermal power. “We’ve already done some experiments with geothermal, with some moderate success,” says Todd Ernst, Director of Aviation Infrastructure, Energy & Environment at Greater Toronto Airports Authority. “All of these projects would be major tasks to take on and the government funds from the cap and trade could help us out.”

The Ontario Cap and Trade Forum takes place at Toronto’s Allstream Centre on April 26-27.

Take advantage of this high-caliber networking opportunity with mandatory participants in Ontario’s cap and trade and key government decision-makers, and gain useful updates on compliance and trading strategies from international carbon market experts.

Visit the event website for more details on the Ontario Cap and Trade Forum, which will bring together regulated entities from Ontario, Quebec and California with key government decision-makers and carbon market experts.