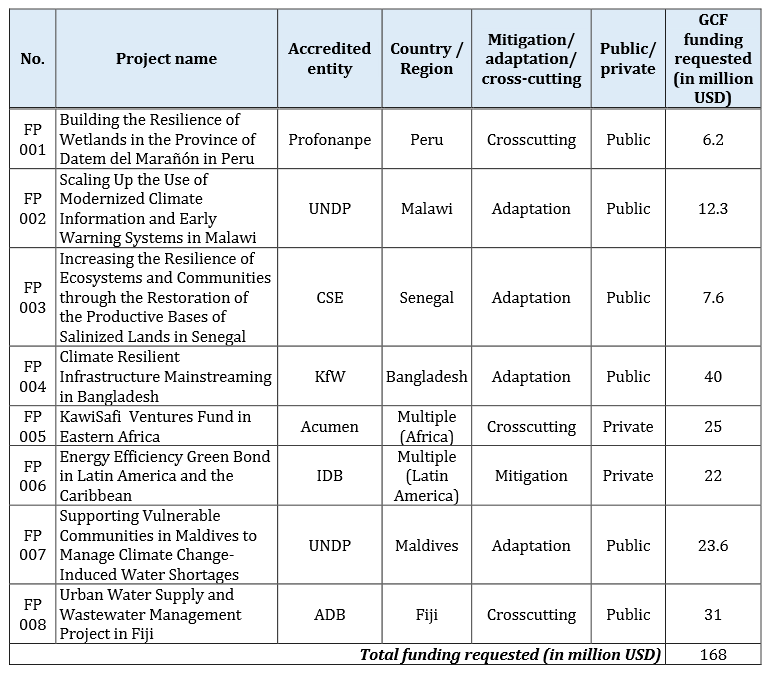

The Green Climate Fund (GCF) board on Friday gave its approval to channel $168 million into eight climate mitigation and adaptation projects across Africa, Asia-Pacific and Latin America, the first award from the fund almost five years after it was set up.

The approval means that all the projects put forward by the secretariat last month were given the green light at the board meeting in Livingstone, Zambia, even though NGO observers had raised concerns around the consultation process and treatment of indigenous peoples’ rights under some of the projects.

“The approved projects showcase the transformative impacts that GCF has been designed to deliver. The fund is now truly up and running, and I am confident the board will go on to scale and fund much bigger projects in the near future,” said board co-chair Henrik Harboe.

Most of the projects focus on adaptation, but the board gave strong backing to an energy efficiency green bond programme in Latin America and the Caribbean, approving $22 million in funding for now while also allocating up to $195 million for the programme’s future phases, a move the GCF said would mobilise an additional $630 million in private funding.

“The energy efficiency green bond is innovative. It demonstrates how capital markets can move mainstream institutional funds into energy efficiency. If replicated, this approach could unlock the capital necessary to address global financing shortfalls in energy efficiency,” said Samy Ben-Jaafar, director of GCF’s Private Sector Facility.

At the meeting, Australia’s Ewen McDonald and South Africa’s Zaheer Fakir were elected as next year’s co-chairs. The next GCF board meeting will be held in Songdo, South Korea in March.

FACTFILE

- The projects cover water access, disaster risk management, land-use management, energy efficiency, and small-scale renewables.

- Just one project was for mitigation only, the rest were either adaptation or both.

- The GCF has pledges of over $10bln pledged by mainly developed nations.

- The fund is required to split 50-50 its cash between adaptation and mitigation.

- Observers expect CDM projects and Programmes of Activities (PoAs) to receive at least a small share of the money.

- The developed world has promised to mobilise $100 billion a year in climate aid by 2020, but not all of it will flow through the GCF.

PRIVATE SECTOR

The two approved projects that were developed by or ultimately involve the private sector:

- KawiSafi Ventures Fund submitted by Acumen, a non-profit group set up in 2001 that raise charitable donations to invest in poverty-alleviating projects. The fund is seeking a $5 million grant for technical assistance and a further $20 million as equity capital to put into a $100 million pot to invest in small off-grid solar companies. It seeks to bring off-grid solar power to 15 million people in east Africa, starting in Rwanda and Kenya. Acumen will receive 20% of the fund’s profits if it achieves a 6% IRR and achieves deployment impacting the full 15 million people, the project document said.

- The Inter-American Development Bank (IDB) is seeking $22 million as an initial tranche to issue a green bond to tap the capital markets to fund energy efficiency projects in Latin America, building on its existing pilot facility in Mexico.

By Stian Reklev – stian@carbon-pulse.com

Not yet signed up to CP Daily? Subscribe to our free newsletter here