By Alessandro Vitelli

Carbon’s been on a bit of a journey in the last week, and to judge from the chatter in the market there really is no end in sight. How high can it go? What can stop it? Who’s going to call the top?

Most of the reasons why carbon is rising are clear and not really new. But what *is* new, to me at least, is the “fine mess” that has developed involving natural gas and carbon prices.

I’ll get to the mess in a moment, but the familiar stuff first:

1. EUA fundamentals – demand. The long term policy outlook is bullish, obviously. Theoretically, this seemingly never-ending rally is actually rational. If you accept that carbon prices should rise until the next tranche of abatement comes within economic reach, then the price rises until someone abates and demand stabilises.

If we agree that coal has been, or is being, marginalised, then we now need to find the next tranche of abatement.

So it makes sense that investors are looking to ride the EUA wave as the EU prepares to reform the market to take on the new 2030 target. Commitment of Traders data shows more than 270 investment funds are active in the market now.

So go on! Fill your boots! Green hydrogen is only €40/t or so away. And if anyone from ESMA asks, tell ’em Frans Timmermans said it’s OK.

2a. EUA fundamentals – supply. There’s been no issuance yet of free EUAs to industry for 2021. So there is no supply from industrials looking to generate some cash, as usually happens from February onwards.

Some of those industrials might want very badly to sell EUAs because they may have had to spend a lot of money to buy back Phase 3 EUAs ahead of the compliance deadline. But there’s nothing to sell until the Commission issues 2021 EUAs, possibly in June.

2b. Fundamentals – demand. Equally, as I try to explain below, coal-fired power seems to be making a bit of a comeback. And of course this means more hedging by utilities.

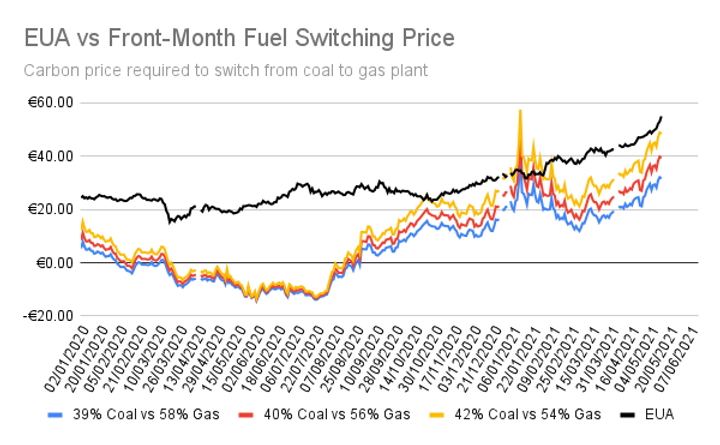

The front-month fuel-switching price calculation shows that the level at which it would be economical to switch from least efficient gas to most efficient coal for power generation is getting pretty close to current EUA levels.

As an example, data from Fraunhofer shows that German coal-fired power generation in the four months through to the end of April was 27% higher year-on-year.

This means more utilities should be back in the market hedging their restarted coal plants.

3a. Fundamentals – supply. The latest TNAC (which covers 2020) reflects the return of UK EUAs to the market in 2020 (after the country was suspended in 2019). This of course is temporary and will be reversed in next year’s TNAC.

However, this means that the MSR will remove more EUAs from the auction programme from September 2021 through to August 2022. Whether you prefer to believe that the higher TNAC is bearish or that the bigger MSR is bullish, well, I can’t help you there.

3b. Fundamentals – supply. On a purely supply-demand basis for 2021, the UK having left the EU ETS means that a net long participant has left the market.

4. Trading. The rally is exacerbated by call options holders who have to increasingly hedge delta on their €50-60-70-100 strike positions as prices rise.

5. Gas fundamentals. Aaaaaaaand here comes the “fine mess” (deep breath).

TTF gas prices are rising very fast, primarily because natural gas supply is tight in Europe, and storages are low.

Why? Because Nord Stream 2 is delayed, and Russia is not making up the shortfall by shipping more gas to Europe via Ukraine.

Higher TTF prices are drawing more LNG to Europe, and this in turn means that Asian prices have to rise to compete, so it all gets a little bit vicious-circly.

A high carbon price naturally means that gas is preferred for power generation. If there was more gas available, the market could supply power generation *and* put gas into storage.

But given that there doesn’t seem to be enough supply to do both, gas needs to price itself *out* of power generation so that it can be stored.

So the gas price needs to rise to the point where coal is brought back into the money.

And if coal burn does recover, utilities will need to buy even more carbon. In fact, some are already reporting increased hedging demand for coal power.

So the “fine mess” is actually some cosmic energy-commodity spiralling vicious circle, where gas and carbon are locked together like two eagles fighting. Once they’ve locked their talons into each other, they can’t let go.

Don’t believe me? Check this out:

And it might only end when Russia decides to get more gas to the European market.

This post was originally published on www.carbonreporter.com