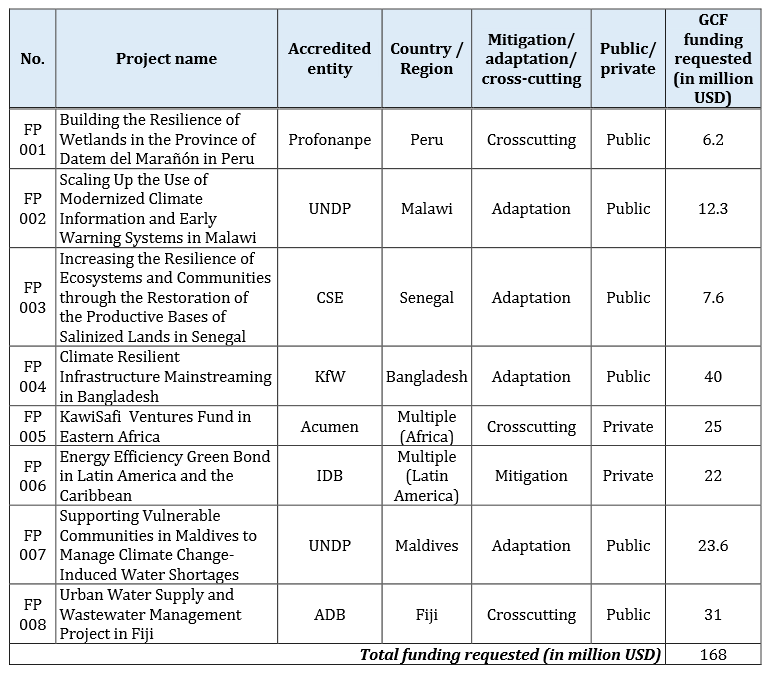

The GCF board will next month decide whether to make its first funding awards of up to $168 million after the secretariat put forward eight mitigation and adaptation projects on Friday, none of which were CDM schemes.

The projects cover a range of activities with three submitted via a more local direct access process and five via multilateral agencies, the GCF said in a statement alongside the board meeting’s draft agenda.

Also on the board’s agenda is the GCF’s acute staffing shortage, which the fund blames on the lack of willingness of candidates to move to its headquarters in Songdo, South Korea, and unattractive salaries, a separate statement said. The board meets over Nov. 2-5 in Livingstone, Zambia.

PROJECT SELECTIONS

The nominated project activities cover water access, disaster risk management, land-use management, energy efficiency, and small-scale renewables drawn from poor nations in Africa, Asia, Latin America and the Pacific Islands.

Just one project – an energy efficiency programme across several Latin American nations – was for mitigation only, the rest were either adaptation or both.

The projects were drawn from 37 shortlisted that are seeking $1.5 billion in total, 29 of those were from public sector bodies.

With huge demand from the developing world to fund mitigation and adaptation activities, the GCF said in June that just a fraction of the 120 project applications worth $6 billion it had received by then “looked promising”.

The GCF has around half of $10.2 billion pledged by mainly developed nations in its coffers and plans to prioritise projects that are not adequately supported by existing climate finance mechanisms, in particular for cities, land management and the resilience of small island states.

Though the fund is required to split 50-50 its cash between adaptation and mitigation, observers expect carbon-cutting CDM projects and Programmes of Activities (PoAs) to apply and receive at least a small share of the money.

PRIVATE SECTOR

Two of the selected projects were developed by or ultimately involve the private sector:

- KawiSafi Ventures Fund submitted by Acumen, a non-profit group set up in 2001 that raise charitable donations to invest in poverty-alleviating projects. The fund is seeking a $5 million grant for technical assistance and a further $20 million as equity capital to put into a $100 million pot to invest in small off-grid solar companies. It seeks to bring off-grid solar power to 15 million people in east Africa, starting in Rwanda and Kenya. Acumen will receive 20% of the fund’s profits if it achieves a 6% IRR and achieves deployment impacting the full 15 million people, the project document said.

- The Inter-American Development Bank (IDB) is seeking $22 million as an initial tranche to issue a green bond to tap the capital markets to fund energy efficiency projects in Latin America, building on its existing pilot facility in Mexico.

The full list is below:

By Ben Garside – ben@carbon-pulse.com