By Alessandro Vitelli

So the latest peak in European carbon prices is over. EUAs climbed to a record of €63.35 on September 8 and have settled back at around €60 over the past week.

I suppose the question is: is that it? Are we done for the year, or are prices going to stage yet another rally?

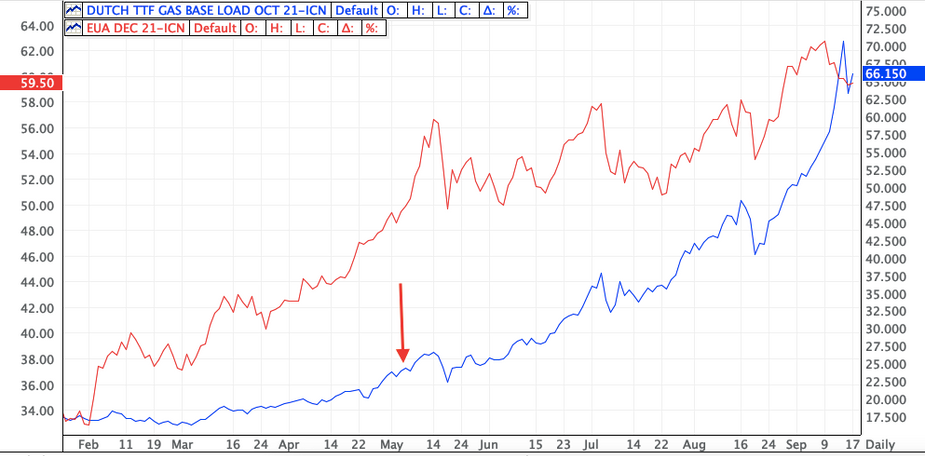

I’ve had a go at explaining carbon’s outstanding performance on a couple of occasions (see here and here) but briefly, TTF prices went through the roof, and EUAs pretty much gave up trying to keep natural gas top of the merit order.

We can slice the price data this in all sorts of fun ways to show this. Warning: charts ahead.

It’s also worth noting how gas performed compared to coal, since the two are the chief fossil protagonists in power generation in much of Europe.

(Comparing front-year TTF prices with EUA or coal prices produces pretty similar charts, if not as extreme).

In both cases the gas price increase this year far outstripped that of carbon/coal, and this completely upended power generation economics:

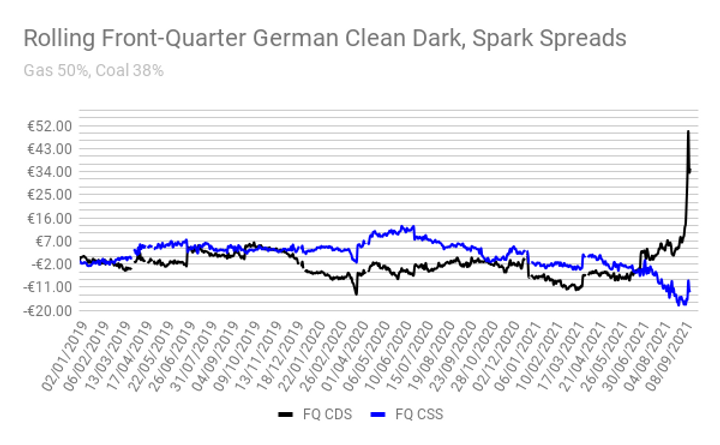

The flip in favour of coal reflects carbon’s inability to rise sufficiently high to continue to price gas into power generation, as the front-month and front-year fuel switch calculations show:

Carbon would have to trade above €80 to bring the least efficient gas plant back for cal-22, and above €150 to flip the front-month merit order.

All of the charts above tell one story: coal is now firmly in charge. Coal burn is now pretty much baked in over the coming winter, and potentially well into next year.

And increased coal burn is – theoretically – supportive of EUAs, since a lot of utilities will have originally planned to run gas this winter, and won’t have bought enough EUAs to cover coal combustion.

This might be a first explanation for carbon’s relative resilience at €60 after coming off from its record high.

If we assume that gas plants were originally priced in for this winter, then you could argue that demand had given us the EUA price that we saw before TTF gas started going through the roof. Looking at the chart of front-month gas prices for the year to date, the spike seems to start as early as late May:

And indeed, the evolution in the cal-22 clean dark and clean spark spreads show that they started to move in opposite directions at around that time. Check out the cal-22 CDS chart above.

The EUA price evolution over the year suggests that carbon did try to keep ahead of gas for a long time, before it became clear to the power market that gas prices weren’t going to stop, and that coal power simply had to restart. Investment players probably took a little longer to come to the same conclusion.

The sharp spike in the clean dark spread (CDS) in the last week is mainly due to German power price’s sudden rise, so it’s worth looking at power prices compared to coal and gas:

It’s hard to see on this chart, but the coal price actually declined from September 13, just when the German power price was hitting top gear and heading for €104.77/MWh on September 15. That brief spell when they were going in opposite directions is where the crazy-looking clean dark spread comes from.

This happened in the space of a week! The CDS was at -€1.85/MWh on September 8 but jumped to nearly €10/MWh by September 15. It’s settled back a little now, but it’s highly possible that some traders got long the clean dark spread and are only now selling it off, which entails buying carbon – another potentially supportive factor.

Last week we also saw increasing interest in the Dec-22 EUA futures as well, which suggests utilities are buying to hedge coal plants that weren’t expected to run.

How do we know? Well, we don’t for certain, but most investors or speculative traders would prefer to trade the most liquid contract for any asset – easiest to get in and get out – and in carbon’s case that’s the front-December. So any increase in activity in a longer-dated contract suggests more fundamental demand.

Going back to gas, it’s possible that TTF prices will remain “elevated” for the winter. Supply issues relating to Russia, Norway and LNG have driven the market to where it is now and of those three, only Norway is likely to be solved this year.

However, once Germany approves the Nord Stream 2 pipeline and gas starts to flow, the general expectation is that prices will come back down, though exactly to what level is best left to the experts.

SEB analyst Bjarne Schieldrop reckons gas might get a sniff of power generation interest at the start of Q2 next year, and he estimates that the price of EUAs required to put gas back in charge in April 2022 is around €60. Conveniently, that’s where prices are today.

That means that EUAs will benefit from coal demand this winter– assuming that seasonal hedging demand is not complete, and that any outstanding short term generation capacity will be hedged along the way. That could support carbon right through until the spring, when things might revert to the new normal, where gas is in the driver’s seat.

So while carbon has come off from its highs, we could argue that it hasn’t come off as much as it might have done, thanks mainly to coal.

But we still haven’t tried to answer the question in the title: is this rally over?

Prices have probably found a level for a while. There are the usual reasons to expect winter demand – particularly if there’s a cold snap anywhere, and there’s plenty of anecdotal evidence to suggest that industrial buyers will look at EUAs below €60.

I’m told that for many industrials the average price is important, so they’ll be looking at the year-to-date average – it’s €47.84 today – and trying to match or beat that. Not much hope of that, I’d think, but the closer to €50 they can buy at, the happier they’ll be.

There are also options traders to consider. The September contract expires next week, and the most open interest in calls is at the €60 and €65 strikes, so we can reasonably expect prices to fluctuate around these levels for another few days.

Once we’ve got September out of the way, we shift to the December contract, where the call strikes with the highest open interest are all at €60 and above – all the way to €100 in fact, where there are 44 million tonnes of open EUA positions.

It’s possible then that the sheer magnetic pull of all this open interest supports EUA prices through to the end of the year.

On the downside, most EU countries haven’t even handed out the free EUAs to their industrial installations yet, seven months after the normal deadline.

In former years, many industrials chose to sell these free EUAs for a one-off gain, and “borrow” the freely-allocated EUAs from the following year, to meet the first year’s compliance obligation. This is possible only because free EUAs are usually handed out in February and March, while the compliance deadline for the previous year is April.

A lot of observers and participants have suggested that because free allocations are getting tighter all the time now and prices are on the rise, that industrials will prefer not to sell their first handout of Phase 4, and instead keep them for future compliance use.

But the very recent energy cost crisis may change attitudes, and companies may decide that selling EUAs at nearly €60 would help them pay their gas bill now, and they can worry about clawing back those allowances later; any time until 2030, in fact.

Once those EUAs start dropping into registry accounts, you can bet the market will be watching like a hawk for any sign of industrials deciding to monetise those EUAs and “borrow” their 2021 compliance from their 2022 handout.

In short, there is a risk that prices may come under pressure if industrials decide to sell their freely-allocated EUAs as soon as they are handed out.

And let’s not forget politics either. The European Parliament is gearing up to start picking apart the Commission’s Fit for 55 package, which contains all sorts of proposed changes to the EU ETS. The market was impressed with the scale of the Commission’s ambition; in fact, it’s one of the main reasons for the price increase this year.

But now starts the detailed legislating, and you can expect a fair bit of volatility as lawmakers discuss the various elements and make their feelings known. (One word of warning: don’t be fooled by talk of emissions trading for buildings and transport into thinking these sectors going to come into the EU ETS. They won’t. But maritime emissions are being lined up to join the EU ETS, just as aviation already is, so there is some new territory to explore.)

And for anyone who’s thinking of the looming UN climate talks, I’m not sure there’ll be much in it for EU carbon. The existing cap-and-trade emissions systems dance to a government tune rather than to the ebb and flow of UNFCCC diplomacy or to the voluntary market, so I wouldn’t expect anything really exciting from Glasgow for any of the big emissions markets.

So is the carbon rally over?

Originally posted on carbonreporter.com