Canada’s provinces should make wise choices when deciding what to do with the proceeds of their carbon pricing schemes, and ensure that any spending programmes are regularly adjusted as the governments’ priorities change.

Those were among the recommendations made by nonpartisan think-tank Canada’s Ecofiscal Commission in a report released Wednesday, which urged provinces to implement carbon pricing as a weapon against climate change but warned them to consider carefully how revenues are recycled.

Major emitting provinces Ontario, Quebec, BC, and Alberta already have or are planning to introduce measures to curb emissions by putting a price on carbon, while several others are currently considering it.

Ecofiscal notes that carbon pricing creates opportunities to carve out broad support for customised, ambitious and smart environmental policy, and that some spending approaches, such as reducing taxes and investing in well-chosen public infrastructure projects, can generate significant economic benefits.

However, carbon pricing initiatives can also be economically regressive if they are not tailor-made based on a province’s individual circumstances or do not channel the revenues collected to areas where they are most needed.

“The revenue presents both opportunities and choices – some are better for the environment, others for the economy. The reality is that each province has unique challenges,” said Commission Chair Chris Ragan, an associate professor of economics at Montreal’s McGill University.

To manage these trade-offs, Ecofiscal made four recommendations:

- Governments should use revenue recycling to address fairness and competitiveness concerns – The potential challenges faced, for example disproportionate costs for low-income households and competitiveness pressures for vulnerable industries, should not preclude implementing carbon pricing.

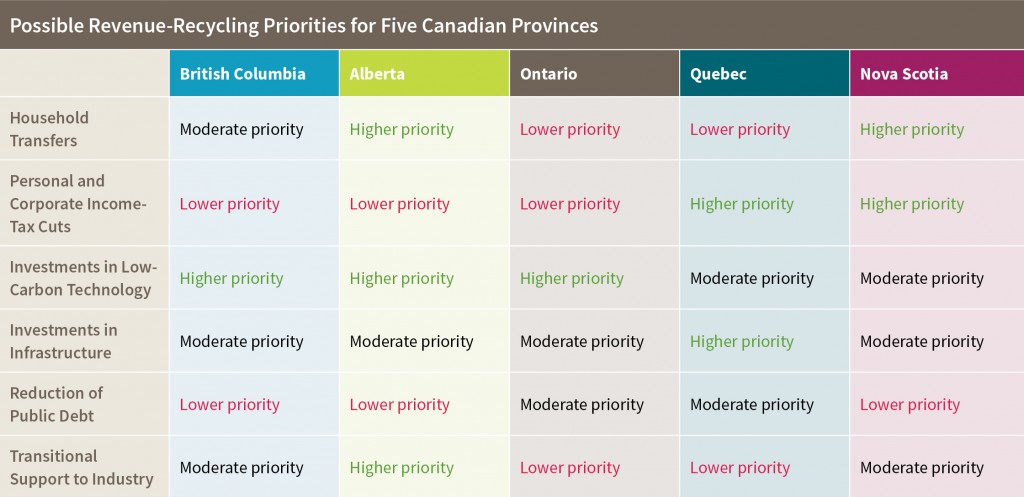

- Governments should clearly define their goals – Provinces will have different objectives depending on their own context and priorities, and identifying them is a crucial for defining optimal approaches.

- Governments should use a portfolio of approaches – No single approach here can address all the concerns associated with carbon pricing, and therefore multiple priorities justify multiple approaches.

- Spending priorities should be adjusted over time – Priorities and challenges evolve over time, and so should revenue-recycling approaches. Some changes in circumstances will be predictable while others will be unexpected, so like other fiscal decisions, revenue-recycling choices should be revisited periodically.

PROVINCIAL CIRCUMSTANCES

The report identifies a number of the issues faced by individual provinces and shows how carbon revenues can target those problems.

For example, Alberta is highly reliant on the fossil fuel industry, and therefore is vulnerable to fluctuations in oil and gas prices while also exposed to the competitiveness pressures created by carbon prices.

“Carbon pricing will increase electricity costs for all users, a burden that will fall disproportionately on low-income households. Our analysis suggests that transferring between 3% and 9% of carbon revenues to [these] households could fully offset this burden,” the report said.

It also suggested using the money to reduce Alberta’s corporate tax rates and invest in large-scale innovation in the province’s oilsands industry, which suffering under rock-bottom crude prices and it about to be hit by higher carbon costs over the next few years.

“Roughly 18% of Alberta’s economy is both emissions-intensive and trade-exposed, compared with 5% for Canada overall … [Revenue] recycling can limit the extent to which emissions in Alberta leak to jurisdictions with weaker carbon policy.”

In contrast, Quebec has a very small heavy-polluting sector but crumbling infrastructure, and high income tax and public debt levels. The report suggests carbon revenues raised through the province’s emissions trading scheme be targeted at these areas.

And Ontario, Canada’s most populous province, has low per capita emissions, but economic growth there has trailed the national rate for the past 15 years, and public debt is equivalent to around 39% of GDP.

While some carbon revenues from Ontario’s upcoming ETS could be used to pay down the provincial debt, the report suggests that a portion of the cash should be used to pour the foundation of a cleantech hub in the province, which already has a highly-skilled workforce, leading universities, and considerable manufacturing expertise.

It also notes that carbon pricing may be mildly regressive for Ontarians, but less than 12% of the province’s total ETS revenues would be required to offset that burden.

Source: Canada’s Ecofiscal Commission

Below is a table of 2013 GHG levels in the ten provinces (in millions of tonnes), the estimated proceeds to be collected under a C$30/tonne carbon pricing mechanism (in C$ millions), and those monetary amounts expressed as a percentage of total government revenues in 2013-14.

| 2013 GHGs | Est. revenues | As % of total govt revenues | |

| BC | 62.8 | 1,407 | 3% |

| Alberta | 267.0 | 5,886 | 13% |

| Saskatchewan | 74.8 | 1,389 | 10% |

| Manitoba | 21.4 | 375 | 3% |

| Ontario | 171.0 | 3,888 | 3% |

| Quebec | 82.6 | 1,755 | 2% |

| New Brunswick | 15.7 | 387 | 5% |

| Nova Scotia | 18.3 | 493 | 6% |

| PEI | 1.8 | 39 | 2% |

| Newfoundland | 8.6 | 213 | 3% |

| TOTAL | 724.0 | 15,832 | N/A |

“Provinces must therefore be mindful of carbon policies in other jurisdictions – including other provinces – when designing their own carbon pricing policies. And governments must also begin considering how to coordinate provincial policies into a coherent pan-Canadian carbon price,” the report said.

Canada’s federal government last month won the support of provincial premiers to introduce nationwide carbon pricing to help the country meet its climate targets, but it was agreed that the measures would be designed over the next six months and that they would be adapted to each province and territory’s specific circumstances.

PRICING POLL

Separately, a nationwide poll of 2,200 Canadians carried out by Abacus Data on behalf of the Ecofiscal Commission found that 75% of respondents thought that carbon pricing was at least an acceptable idea, with 40% believing it was either a ‘good’ or ‘very good’ idea.

In terms of spending carbon price revenues, just under half of those polled said the cash was best invested in infrastructure improvements, research & development, and low-carbon technologies.

Some 18% said the funds should be repaid to the public in the form of a dividend, while 16% called for taxes to be cut by an equivalent amount.

“Ideas like tax neutrality and revenue recycling helps build support for carbon pricing, an effect which is evident in all parts of the country and across the left, centre and right of the political spectrum,” Abacus said.

Only 10% of those polled said the money should be used to pay off public debt, with 5% calling for financial support for large emitters to transition to cleaner operations.

By Mike Szabo – mike@carbon-pulse.com